3 Frameworks for Sustainable Investment

Jacquelyn Humphrey and Saphira Rekker

Chapter Overview

At the end of this chapter you will be able to:

-

- Understand the importance of collective action and the main initiatives to which organisations can pledge commitment to sustainability

- Understand how sustainability is measured

- Evaluate different sustainability ratings schemes

Collective Action/Pledges and Commitments

As we have seen in prior chapters, sustainability is becoming increasingly important to our society. However, how can organisations become more sustainable? Many initiatives have come into existence which provide a network and support for organisations that want to operate more sustainably. In this section we will review some of the larger initiatives.

One criticism of these initiatives is that they are voluntary. This can mean that signatories can decide not to take their commitments seriously, and also the commitments cannot be enforced (other than potentially delisting the organisation from the initiative). This in turn can lead to criticisms of greenwashing. Greenwashing is a commonly used term to describe misleading, or dishonest, information provided by an entity to make it appear more sustainable than it is.

Greenwashing

Greenwashing occurs in many different forms, and regulatory bodies are increasingly focused on ensuring that accurate information is provided – particularly in relation to climate change (see Chapters 5 and 6). For example:

The EU has developed several different requirements on what can be labelled as a sustainable or “Paris-aligned” activity or investment product.

In June 2022, the Australian Securities and Investment Commission (ASIC) released guidelines on avoiding greenwashing in investment products and has made action against greenwashing one of its enforcement priorities for 2023 and 2024. In 2023, ASIC sued several financial institutions for greenwashing, for example Vanguard and Active Super.

In addition, international guidelines to prevent greenwashing in climate reporting have been provided by the UN Integrity matters report, which was focal during COP27.

Discussion: Short Case Study – VW “Clean Diesel” Campaign

A particularly noteworthy example of greenwashing was Volkswagen’s “Clean Diesel” campaign which was centred around the promotion of its diesel vehicles as environmentally friendly and fuel-efficient. The campaign, which began in the late 2000s and continued for several years, marketed Volkswagen’s TDI (Turbocharged Direct Injection) diesel engines as a “clean” alternative to traditional gasoline engines, emphasising their low emissions and high performance. However, in 2015 it was revealed that Volkswagen had installed illegal software, known as a “defeat device”, in millions of its diesel vehicles. This software was designed to detect when the vehicle was undergoing emissions testing and reduce emissions to pass the test. However, under normal driving conditions, the vehicles emitted pollutants at levels far exceeding regulatory limits. The emissions scandal, known as Dieselgate, had severe consequences for Volkswagen. The company faced billions of dollars in fines and settlements, a significant drop in sales and stock value, and damage to its reputation. The scandal also led to increased scrutiny of emissions testing and regulation in the automotive industry.

Volkswagen emissions scandal: A timeline (YouTube, 3m47s)

Exercise

Answer:

- The Global Reporting Initiative (GRI) and the Carbon Disclosure Project (CDP) require comprehensive environmental impact reporting, making it harder for companies to conceal harmful practices.

- The Task Force on Climate-Related Financial Disclosures (TCFD) promotes the disclosure of climate-related risks and opportunities, encouraging companies to integrate sustainability into their financial planning.

- The International Financial Reporting Standards (IFRS) S1 and S2 enhance the reliability and comparability of sustainability disclosures, aiding investors in making informed decisions.

- The Australian Sustainable Finance Institute’s (ASFI) taxonomy development and the EU climate benchmarks provide clear guidelines for sustainable finance, helping to identify genuine green investments.

- Sustainability ratings agencies play a critical role by evaluating and verifying corporate sustainability claims, thus maintaining market integrity.

- Effective prevention of greenwashing also requires regulatory oversight. Authorities must enforce compliance with these frameworks and impose significant penalties for violations. By fostering a culture of transparency and accountability, these initiatives can ensure that companies prioritise genuine sustainability over deceptive marketing practices, protecting both the environment and consumer trust.

United Nations Global Compact

In Chapter 2 we introduced the Sustainable Development Goals. Organisations, including companies, have a part to play in meeting the SDGs, and the United Nations Global Compact (UNGC) was launched in 2000 to assist them to do this. The UNGC is the largest global corporate sustainability initiative and has over 23,000 signatories from 166 countries. Well-known Australian and New Zealand UNGC signatories include Bunnings Group, Coles Group, and Air New Zealand.

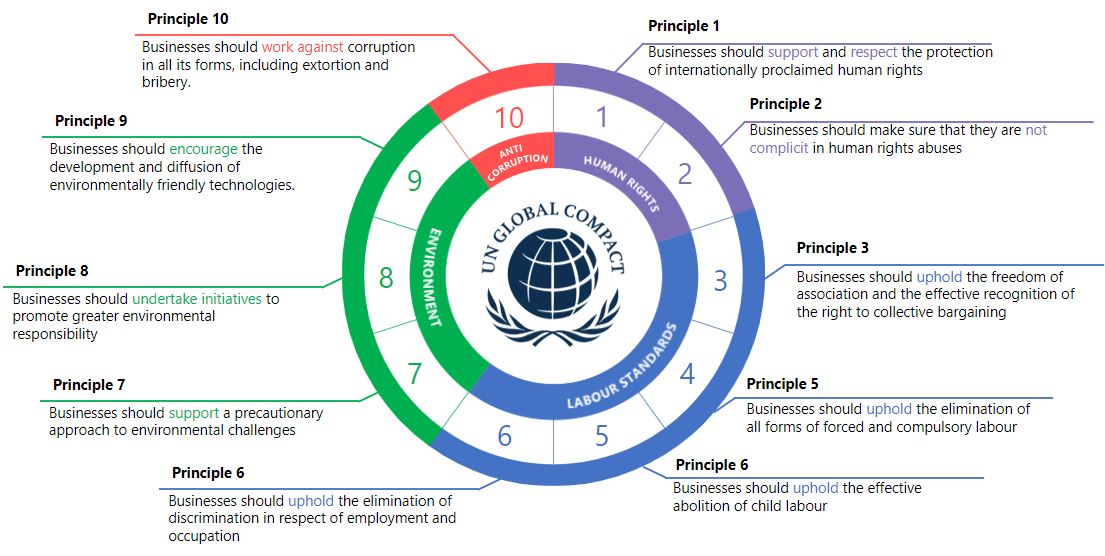

UNGC signatories commit to responsibility in their everyday operations, strategies and culture across four areas: human rights, labour, environment and anti-corruption. UNGC signatories are required to implement ten principles, shown in the graphic below, and communicate how they are implementing these principles in their annual or sustainability report. The UNGC also provides education and training to its signatories on how they can more effectively embed the SDGs into their businesses.

Uniting business for a better world: 20 years of the UN Global Compact (YouTube, 1m 32s):

Concept Check

Which of the four areas do each of the 10 UNGC principles apply? (Drag and drop each grey box to a relevant column).

Principles for Responsible Investment

The United Nations-supported Principles for Responsible Investment (PRI) is another important large global sustainability initiative. The PRI was designed to help the finance industry – asset owners, investment managers and service providers – to become more sustainable by integrating ESG factors into investment and operating decisions.

The PRI was launched in 2006 with 46 signatories, including two from Australia and New Zealand. The number of signatories has grown astronomically since its launch and today there are over 5,300 global signatories. More than 260 signatories are from Australia and New Zealand – including BP Funds Management (NZ) Ltd, City of Brisbane Investment Corporation and New Zealand Superannuation Fund.[1]

PRI signatories commit to six Principles on how they will operate and invest. The list of Principles can be seen in the figure below. Signatories are also required to report annually to the PRI on their progress on ESG issues. Signatories that fail to report for two years are delisted.

The PRI also provides education and investor tools for its signatories to help them to become more sustainable. PRI conferences and workshops provide an opportunity for signatories, and academics working in ESG, to share knowledge and information, and network.

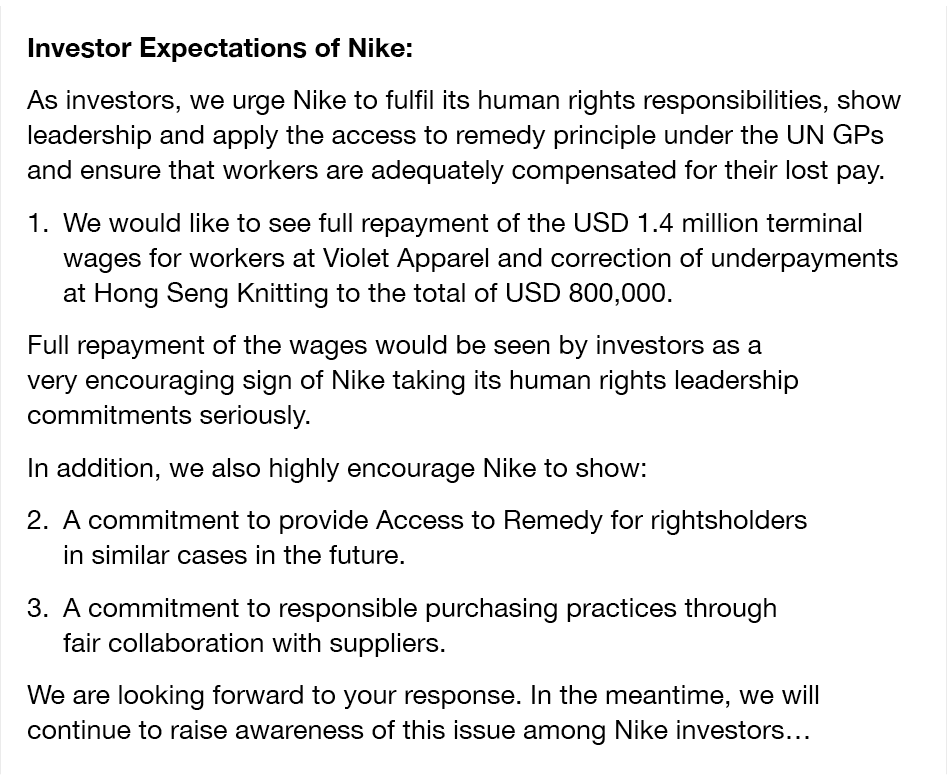

In addition, the PRI facilitates collective action on ESG issues e.g., writing joint letters to companies, engaging or voting collectively on ESG issues. A recent example of a collective action coordinated by the PRI is when signatories could sign a letter addressed to Nike for reparations because their largest supplier had not paid wages to 4,500 garment workers in Cambodia and Thailand.

Concept Check

Below is an excerpt from the letter sent to Nike on 7 September 2023 as part of the collective action coordinated by PRI.

The letter mentions that Nike has already made commitments to upholding human rights, but the letter is addressing what appears to be a failure to adhere to those commitments.

Answer:

- By mobilising a coalition of investors, PRI leverages significant financial influence to demand accountability. In the case of Nike’s unpaid wages to garment workers, the coordinated letter represents the voices of multiple investors, amplifying the call for reparations.

- Such collective actions draw public attention to corporate malpractices, increasing reputational risk for the company. Investors’ demands for full repayment of wages and commitments to future remedial actions underscore the importance of corporate social responsibility. This public scrutiny can prompt Nike to address the issue promptly to maintain its market position and investor confidence.

- Additionally, the PRI’s emphasis on adherence to the UN Guiding Principles on Business and Human Rights (UNGPs) aligns investor expectations with globally recognised standards. This alignment strengthens the moral and legal imperatives for Nike to act responsibly.

- By signalling that they will continue to raise awareness among Nike’s investors, PRI ensures sustained pressure, potentially affecting Nike’s stock value if the company fails to comply.

Other Sustainability Initiatives

Recent years have seen a proliferation of voluntary sustainability initiatives, many of which focus on one particular issue. The table provides information on some of the larger initiatives.

Sustainability initiatives

| Initiative name | Summary | Number and type of signatories |

|---|---|---|

| Climate Action 100+ | Investor-led initiative to engage with companies on how they are taking climate-related action. Launched in 2017. | Over 700 investors |

| Net Zero asset owner alliance | Convened by the UN. Investor-led initiative of institutional investors who commit to transitioning their portfolios to net zero emissions by 2050. Launched in September 2019. | 86 asset owners, with combined worth of US$11 trillion |

| Net Zero asset managers | Convened by the UN. Asset managers who support and commit to investment aligned with achieving net zero emissions by 2050. Launched in December 2020. | Over 315 signatories with US$59 trillion in AUM |

| Net Zero banking alliance | Convened by the UN. Leading global banks who commit to financing climate action to meet net zero emissions by 2050. Launched in April 2021. | 133 banks worth US$74 trillion (41% of banking assets globally) |

| Investor group on climate change | Australian and New Zealand Institutional investors. Commit to accelerating progress on climate change. Established in 2005. | 103 members |

| New Plastics Economy | Launched by Ellen MacArthur foundation and UN Environment Programme. Targets the production, use and reuse of plastics, and work towards a circular economy for plastics. Launched in 2018 | Over 500 signatories, including corporations and governments |

| High ambition coalition to end plastic pollution | Intergovernmental group to end plastic use 2040. Launched in March 2022. | 60 countries |

| Valuing water finance initiative | Investor-led group facilitated by Ceres, a sustainability NGO. Designed to engage with companies that use and pollute a large amount of water on water management and protecting global fresh water resources. Launched in August 2022. | 85 investor signatories with approximately US$14 trillion in assets under management. |

| High ambition coalition for nature and people | Intergovernmental group to conserve and manage at least 30% of global land and oceans by 2030. Launched in January 2021. | 115 countries |

| Investors Against Slavery and Trafficking Asia Pacific | Investor-led group along with the Australian Council of Superannuation Investors, Walk Free and the Finance Against Slavery and Trafficking initiative. Targets slavery and human trafficking in companies in the Asia Pacific. Launched in 2020. | 45 investors with approximately AUD11.9 trillion in assets under management. |

Exercise: Investor Group on Climate Change

At the start of this chapter, we mentioned that a criticism of these sustainability initiatives is that they are voluntary and unenforceable and may mean that signatories do not take their sustainability commitments seriously. This could mean that companies sign up to help them appear to be more sustainable than they are, and lead to accusations of greenwashing.

To help demonstrate this, visit the Investor Group on Climate Change website and navigate to its “our members” page to look at the companies that are listed. Then, go to the Climate Wreckers Index report by Market Forces and tally up the number of Investor Group on Climate Change member companies that are listed. The Climate Wreckers Index lists Australian superannuation funds that, in 2023, were investing in companies involved in expanding fossil fuels. One might think that being signed up as a member of the Investor Group on Climate Change would mean that the member companies are investing sustainably, but this is not necessarily the case.

Measuring Sustainability

The next question is how organisations can measure, report on and communicate their sustainability to their stakeholders. Without consistent compulsory international reporting standards, there is a huge diversity in how this information could be reported. Consequently, several frameworks have been developed which are designed to assist organisations to report this information in a standardised, informative way.

Global Reporting Initiative

The Global Reporting Initiative (GRI) was one of the earliest initiatives to provide a sustainability reporting framework. The GRI was launched in 1997 and now is the most widely used sustainable reporting standard, with more than 10,000 organisations across 100 countries reporting using the GRI standards. The GRI is governed by the Global Sustainability Standards Board. The Standards are reviewed regularly to ensure they reflect global best practice.

The GRI standards are a “modular” system of three series of standards:

- GRI universal standards, which provide disclosure and guidance on topics that are likely to be material for all organisations.

- GRI sector standards, which are tailored for specific sectors and (will) cover 40 sectors e.g. Oil and gas; Textiles and Apparel.

- GRI topic standards, which relate to a specific sustainability issue e.g. human rights, waste.

Carbon Disclosure Project

The Carbon Disclosure Project (CDP), also a not-for-profit organisation, focuses specifically on enabling companies to disclose their greenhouse gas emissions and other climate-related information, as well as water usage. The CDP has become the leading global organisation through which companies and cities report their greenhouse gas emissions data. CDP data is widely used by investors, data providers, academics and governments for decision-making, product offerings and research.

As at the beginning of 2024 there were companies, cities, states and regions from over 90 countries disclosing through CDP on an annual basis. This includes over 23,000 companies worth more than half of global market value.

For an idea of what companies are asked to disclose, have a look at CDP’s questionnaires.

In 2021, the CDP launched a new strategy that aims to expand to cover all planetary boundaries, including other areas such as biodiversity, plastics and oceans, and recognises the interconnectedness of nature and earth’s systems (see Chapter 5).

Since the Paris Agreement in 2015 there has been a large increase in reporting frameworks and guidelines. Initially, the CDP provided an overview of how its reporting aligned with and differed from the GRI. Now, the CDP has aligned its reporting standards with the recommendations by the Task Force on Climate-related Financial Disclosures (TCFD), which is discussed next.

Task Force on Climate-Related Financial Disclosures (TCFD)

Following the Paris Agreement in 2015 an important international financial body – the Financial Stability Board – set up a Task Force to develop guidelines on climate risk disclosures. It was tasked to identify the financial risks and opportunities associated with climate change, and to provide global guidelines on how to report on these. These guidelines were published in 2017 and have formed the groundwork for other guidelines and initiatives on climate, including from regulatory bodies across the world.

Explained | Task Force on Climate-Related Financial Disclosures (TCFD) (YouTube, 2m 19s):

The significance of the TCFD as a milestone in climate reporting cannot be understated. The TCFD has been so influential because it was a document written by a globally significant financial body, led by well-known leaders in the financial sector. The Task Force was led by Michael Bloomberg, founder of Bloomberg, a world-leading financial information provider, and presented to the Financial Stability Board’s Chair, Mark Carney, former governor of the Bank of England.

The TCFD is focused on increasing transparency to make “markets more efficient and economies more stable and resilient”.[2] It streamlines climate reporting and classifies its disclosures according to four categories (see the figure below). At the core of the TCFD are metrics and targets, as a foundation for what is needed to start managing climate risks, setting a strategy, and consequently governing the organisation.

Each category has several recommended disclosures, including explanations of what should be included in the disclosure. For example, for metrics and targets, one of the recommended disclosures (disclosure c) is “Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets”[3] and then there is a description of what should be disclosed, including several elements on the type of target, time frame, base year from which progress is measured, and key performance indicators used to assess progress against targets. There are disclosure guidelines that apply to all sectors, but the TCFD has also increasingly published sector-specific guidelines.

Climate-related risks and opportunities and their impact on the financials of an entity can also be divided into different categories (see the figure below). Broadly speaking there are two types of climate-related risks: transition risk and physical risk. Transition risk refers to the risks associated with the world transitioning to a lower carbon, and ultimately fully decarbonised, economy. These risks include policy and legal (increased regulation and litigation), technology (innovations), market (supply and demand) and reputation (stakeholder perceptions) risk. The more rapidly economies transition, the greater the transition risk. Physical risk, however, increases the more rapidly the climate changes. Physical risks are the risks associated with a warming planet. Some risks are acute, such as extreme weather events. Others are chronic, such as sea level rise and water scarcity. Fortunately climate change does not only come with risks, it also comes with opportunities. Addressing climate change provides opportunities in using resources more efficiently and changing sources of energy (potentially saving costs!), innovating to provide new products and services, entering new markets, and ultimately make organisations more resilient to climate-change-related risks.

Some countries, like New Zealand, have already integrated climate-related disclosure requirements based on the TCFD.

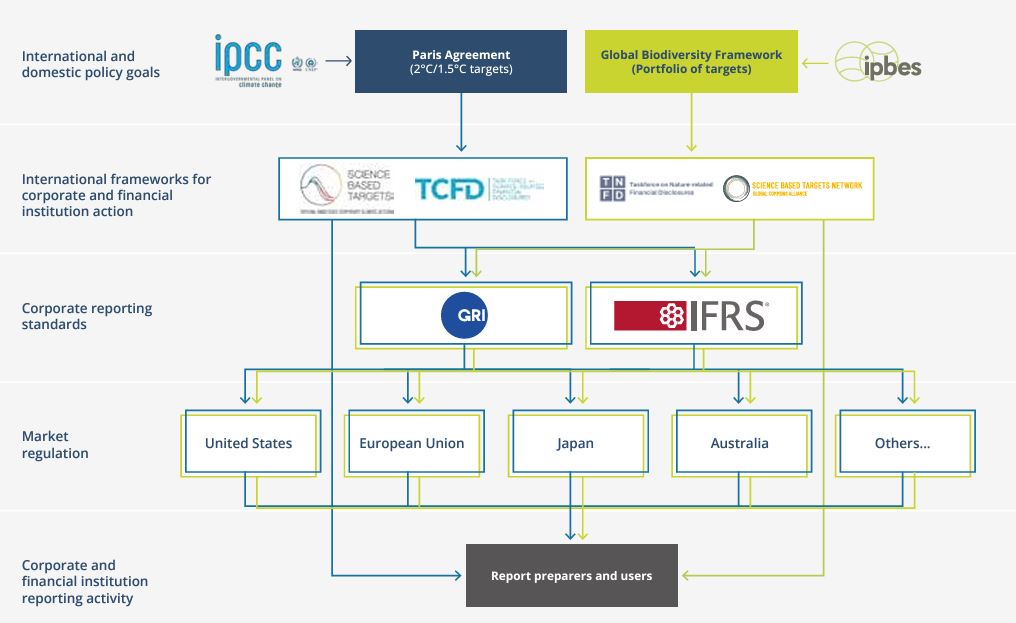

Following the TCFD, a similar task force was established but for a broader purpose; nature-related disclosures: Taskforce on Nature-Related Financial Disclosures (TNFD). The TNFD follows a similar structure to the TCFD in terms of the elements covered (governance, strategy, risk management, and metrics and targets). It recognises other natural systems that are important to maintain for financial stability, covering biodiversity and other planetary systems (using the planetary boundaries concept we cover in Chapter 5). The figure below demonstrates how the TCFD and TNFD are informed by international policy goals, and are currently being worked into corporate reporting standards, including the IFRS which we discuss next.

International Financial Reporting Standards (S1, S2)

You are probably familiar with the International Financial Reporting Standards (IFRS), which are issued by the International Accounting Standards Board. The IFRS are international standards for how to report on financial data, making statements comparable across international boundaries. In 2021, the IFRS Foundation established the International Sustainability Standards Board in response to demand for global sustainability reporting guidelines. In 2022 the first two drafts of IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures) were issued, with the latter built on the recommendations by the TCFD and sector-specific guidelines from the Sustainability Accounting Standards Board. In June 2023, the IFRS S1 and S2 were officially issued.

Many countries are in the process of integrating the IFRS S1 and S2 into their national reporting requirements.

Test Your Knowledge

Taxonomies and Other Sustainable Finance Frameworks

The EU has been a leader in the area of sustainable finance frameworks and standards. The aim is to facilitate sustainable investment and increase capital flows to support the EU’s green deal and achieve the EU’s sustainability objectives.

In 2018 it set up a Technical Expert Group to assist with developing items as listed in their legislative proposals:

- an EU taxonomy: a classification system that specifies whether an economic activity can be regarded as environmentally sustainable

- an EU Green Bond Standard: which we briefly discussed in Chapter 3

- a methodology for EU climate benchmarks and disclosure for ESG benchmarks.

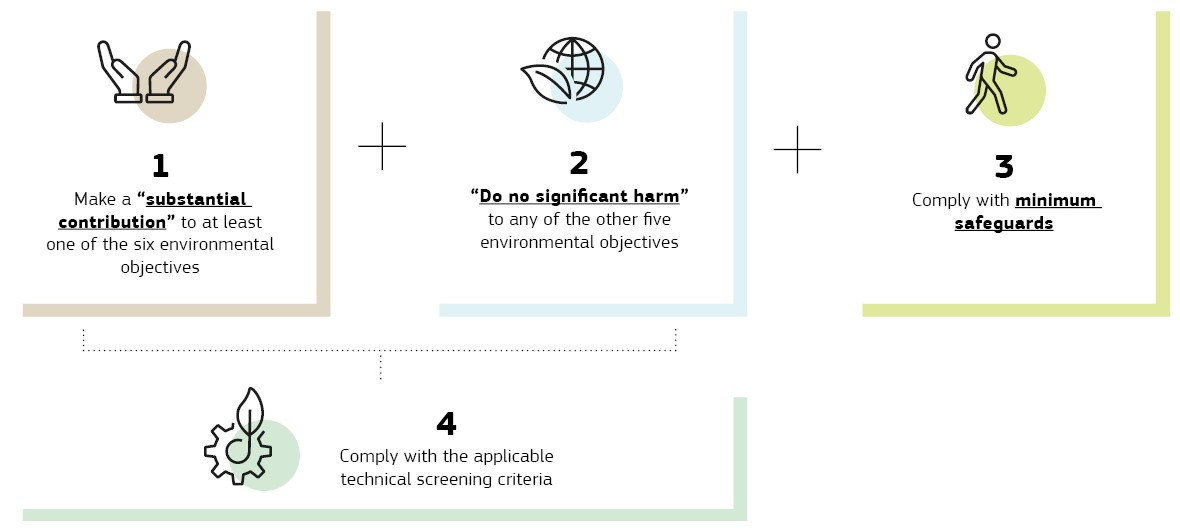

The EU’s taxonomy came into force in July 2020. For an activity to be classified as sustainable, it must:

- (1) make a “substantial contribution” to at least one of six environmental objectives – climate change mitigation, climate change adaptation, sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystems. Then, it needs to also make sure it does

- (2) “no significant harm” to any of the other five environmental objectives and

- (3) comply with minimum safeguards (social standards) and

- (4) comply with the applicable screening criteria of (1) and (2).

Australian Sustainable Finance Taxonomy Development

In 2022 there were over 15 taxonomies globally, as outlined in the Australian Sustainable Finance Institute (ASFI) Taxonomy Project’s analysis of international taxonomies and considerations for Australia.[4]. The number of sustainable finance taxonomies is increasing – in 2024 it had increased to 26. ASFI is in the process of developing a taxonomy for Australia. Such a classification system will standardise what encompasses a sustainable activity and make it easier for capital to flow to sustainable activities.

EU Climate Benchmarks

In 2020 the EU had officially adopted regulation on the minimum standards for a benchmark to be classified as “Climate Transition” or “Paris-aligned”. This is aimed at reducing the risk of greenwashing, and increases the transparency and comparability of information on different benchmarks. Benchmarks are important in the financial industry, as funds often are required to compare themselves against benchmarks, or directly invest in index funds that replicate a certain index. Many index funds label themselves as “green”, “low carbon”, etc, but this regulation ensures that only funds that meet certain requirements can have a certified EU label of being a “Climate Transition Benchmark” or a “Paris-aligned Benchmark”. The requirements are for the funds to “(a) for equity securities admitted to a public market in the Union or in another jurisdiction, at least 7% reduction of GHG intensity on average per annum; (b) for debt securities other than those issued by a sovereign issuer, where the issuer of those debt securities has equity securities admitted to a public market in the Union or in another jurisdiction, at least 7% reduction of GHG intensity on average per annum or at least 7% reduction of absolute GHG emissions on average per annum; (c) for debt securities other than those issued by a sovereign issuer, where the issuer of those debt securities does not have equity securities admitted to a public market in the Union or in another jurisdiction, at least 7% reduction of absolute GHG emissions on average per annum.”[5]

Fun fact

One of the authors of this chapter made a key contribution to the climate benchmarking regulation by assisting with the modelling of the 7% reduction. This 7% was derived from the IPCC Special Report on 1.5°C, based on scenarios that had “no or limited overshoot”.

The IPCC’s report in 2018 provided six categories of emission pathways – four categories that meet the 1.5°C and two categories that meet the 2°C goals by 2100, where differences depend on the allowance of an “overshoot” and different probabilities of meeting the temperature goal. If a pathway allows for a temporary overshoot of the temperature, it means it relies on large-scale deployment of carbon dioxide removal (CDR) measures, which are uncertain and entail clear risks (Rogelj et al, 2018).[6] Based on the Precautionary Principle (UN, 1992, Principle 15)[7] therefore, we proposed the use of the scenarios that had “no or limited overshoot”.

Concept Check

Sustainability Ratings Agencies

Ratings agencies are organisations that rate other organisations. The most well-known are probably credit ratings agencies – the largest of which are Standard and Poor’s, Moody’s and Fitch – which assign companies and governments scores on how likely they are to be able to repay their debts.

Similarly, there are sustainability ratings agencies, which are independent organisations that assess and then provide ratings on how sustainable companies are. The ratings are usually based on publicly available information (such as from companies’ sustainability reports), but can also include interviews with company management, or information from the media. The ratings usually start by assessing very granular-level information, and then are aggregated up to give an overall sustainability or ESG rating. An example of such a rating scheme is in the figure below.

Recent years have seen a huge increase in the number of sustainability ratings agencies. Unfortunately, each ratings agency uses its own methodology and criteria for rating companies. This has led to criticisms, because the sustainability ratings of a particular company are not consistent across the ratings agencies.

Measuring Climate Performance

Given the (long-term) financial success of sustainable investment funds, and demand from clients, many funds now offer sustainable and responsible investment options (see e.g. Morgan Stanley). However, how responsible or sustainable are these investments?

Research by Rekker, Humphrey and O’Brien (2019) found that sustainability ratings often used by investors to make sustainable investment decisions do not measure how consistently a company is operating with e.g. meeting global climate goals (so how can we create climate-safe investment portfolios?). The role of sustainability rating agencies is to analyse company data and provide independent assessments on their sustainability. The landscape is quickly changing, however. Over the past few years there have been major developments in the required disclosure and action of companies on climate change as we have seen in this chapter.

Whilst more science-based approaches to measuring companies targets and the progress against these targets have been developed, e.g. the Science-based Targets initiative and the Transition Pathway Initiative, they still exhibit some shortcomings. To measure climate performance using a strict science-based approach, Rekker et al. (2022) propose several conditions and requirements in order to develop a “Paris Compliant Pathway”. This will be further discussed in Chapter 6.

Review Questions

Complete the chapter review questions below to test your knowledge.

- Principles for Responsible Investment. (n.d.). About the PRI. https://www.unpri.org/about-us/about-the-pri ↵

- Task Force On Climate-Related Financial Disclosures [TCFD]. (2017). Metrics and targets. https://www.tcfdhub.org/metrics-and-targets/, p. 3 ↵

- Task Force On Climate-Related Financial Disclosures. (2017). Metrics and targets. https://www.tcfdhub.org/metrics-and-targets/ ↵

- Australian Sustainable Finance Institute. (2022). Analysis of international taxonomies and considerations for Australia. https://www.asfi.org.au/publications/international-scoping-paper ↵

- Commission Delegated Regulation (EU) 2020/1818. (2020). http://data.europa.eu/eli/reg_del/2020/1818/oj ↵

- Rogelj, J., Shindell, D., Jiang, K., Fifita, S., Forster, P., Ginzburg, V., Handa, C., Kheshgi, H., Kobayashi, S., Kriegler, E., Mundaca, L., Séférian, R., & Vilariño, M. V. (2018). Mitigation pathways compatible with 1.5°C in the context of sustainable development. In P. Z. V. Masson-Delmotte, H. O. Pörtner, D. Roberts, J. Skea, P. R. Shukla, A. Pirani, W. Moufouma-Okia, C. Péan, R. Pidcock, S. Connors, J. B. R. Matthews, Y. Chen, X. Zhou, M. I. Gomis, E. Lonnoy, T. Maycock, M. Tignor, T. Waterfield (Eds.), Global warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. In Press. https://www.ipcc.ch/site/assets/uploads/sites/2/2019/02/SR15_Chapter2_Low_Res.pdf ↵

- United Nations. (1992). Rio declaration on environment and development. https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_CONF.151_26_Vol.I_Declaration.pdf ↵