49 Public budgeting and resource management

Ben Spies-Butcher and Gareth Bryant

Key terms/names

competition policy, environmental valuation, fiscal policy, gender budgeting, generational accounting, liberalisation, marketisation, Modern Monetary Theory, national accounting, new public management, outsourcing, Parliamentary Budget Office, public debt, social investment, tax expenditures, taxation, welfare state

Introduction

Public budgets are important tools for managing resources and holding governments to account.[1] The federal budget is one of the most important annual political events, with live coverage and extensive reporting in the media, and lengthy Senate Estimate sessions, where ministers and senior public servants are called to answer questions from senators related to the budget. At all levels of government, budgets set out government priorities by appropriating revenues and allocating resources. In Australia, the politics of achieving budget surpluses has proven a powerful weapon in elections.

The role of public budgets has changed over time, reflecting shifts in ideology and the balance of economic and political power. Changes to budgeting rules have been key to the liberalisation of the economy and the rise of new public management, by transforming states to more closely resemble corporations or markets. Alternatively, budgeting has been used to reveal gendered inequalities and ecological harms. Understanding public budgets involves much more than understanding fiscal accounting terms; budgets reveal what Goldscheid called the skeleton of the state[2] and the organisation of state power.

Introducing the budget

Budget night is a major event in Australia’s political calendar. Usually in May, the federal treasurer stands up in parliament to deliver a speech about the government’s major spending and taxing priorities for the year, and the expected budget outcome – whether a surplus or a deficit. Journalists, who have spent all day poring over budget papers in the budget ‘lock-up’ room, then go on television, radio and online to analyse the winners and losers of what has been announced.

Budgets can be an intimidating collection of abstract figures, forecasts and concepts. Even more mystifying is the political spin that accompanies the budget. Yet you do not need to be an accountant or economist to understand how budgets work, the principles of taxation or the place of budgets in Australian political history. The mechanics of budgeting are not a technical issue best left to experts but a window through which we can see major shifts in Australia’s economy, society, politics and environment.

Key economics terms

Aggregate demand is a concept for understanding how much consumers and producers are willing or planning to spend across the entire economy. It is commonly used for macroeconomic management, where governments attempt to increase or decrease aggregate demand to manage levels of growth, inflation and unemployment.

Central banks play a privileged role in the financial system, with various powers to set monetary policy, produce and distribute money and credit, and oversee private banks. Australia’s central bank is the Reserve Bank of Australia, which is owned by the federal government but acts independently via an appointed board.

Fiscal policy refers to the taxing and spending powers of government. The direction of fiscal policy is set by parliament through budgeting processes and carried out by the executive. Treasury and finance departments are central to the exercise of fiscal policy.

Gross Domestic Product, or GDP, is a common measure used to track the overall growth of a national economy. It measures the market value of all goods and services produced within a nation’s borders in a year.

Government bonds are the financial instruments used by governments to borrow money. Governments issue bonds to finance expenditure, which are repaid with interest. Outstanding bonds are the ‘sovereign debt’ of a country.

Inflation measures the average change in prices across an economy. Rising inflation suggests the value of money is falling, meaning a given amount of money can buy fewer goods and services.

Macroeconomic Macroeconomics is a branch of economics that focuses on the overall operation of national economies. Macroeconomic management refers to the use of fiscal and monetary policy to influence aggregate demand in a national economy.

Monetary policy refers to the tools used by central banks to manage the supply of money in an economy. The main tools of monetary policy involve setting official interest rates, and buying or selling financial assets, such as government bonds (known as quantitative easing and tightening).

Unemployment refers to people who are looking for work but not employed. Unemployment rates measure the proportion of the workforce in this situation and are a key indicator of economic conditions.

How do budgets work?

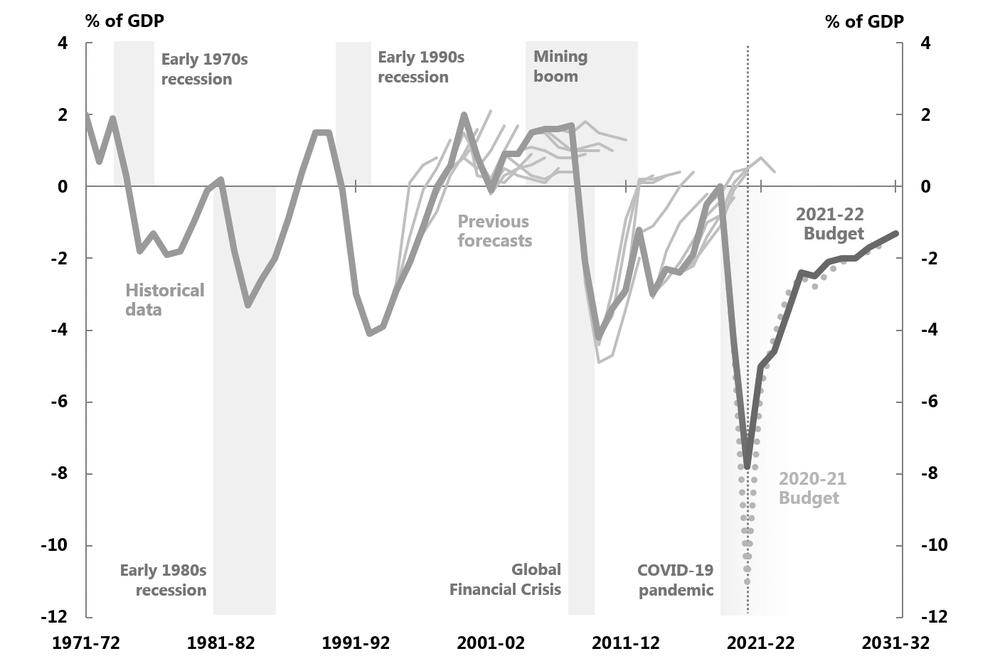

In simple terms, budgets account for the finances of government. The headline figure of a budget is the budget outcome, which reports the difference between a government’s revenue and expenditure in a given fiscal year. The budget outcome can either be in surplus (revenue exceeds expenditure) or deficit (expenditure exceeds revenue). Budget outcomes are influenced by the spending and taxing policies of government, and their interaction with broader macroeconomic conditions, such as levels of economic growth, inflation, and unemployment (see the key economics terms box). While budget surpluses have held a tight grip over Australian politics, Figure 1 shows that budget deficits have been more common, even during the ‘neoliberal’ period, since the 1980s. The graph illustrates how budget outcomes are affected by macroeconomic events, such as crises and booms, and the tendency of governments to present overly optimistic forecasts of the ‘return to surplus’.

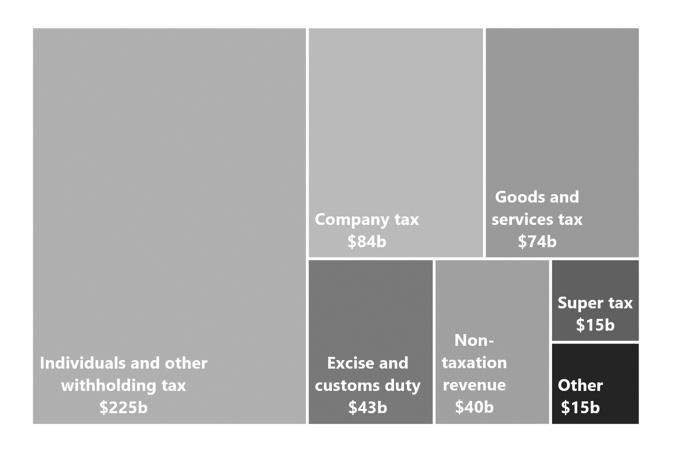

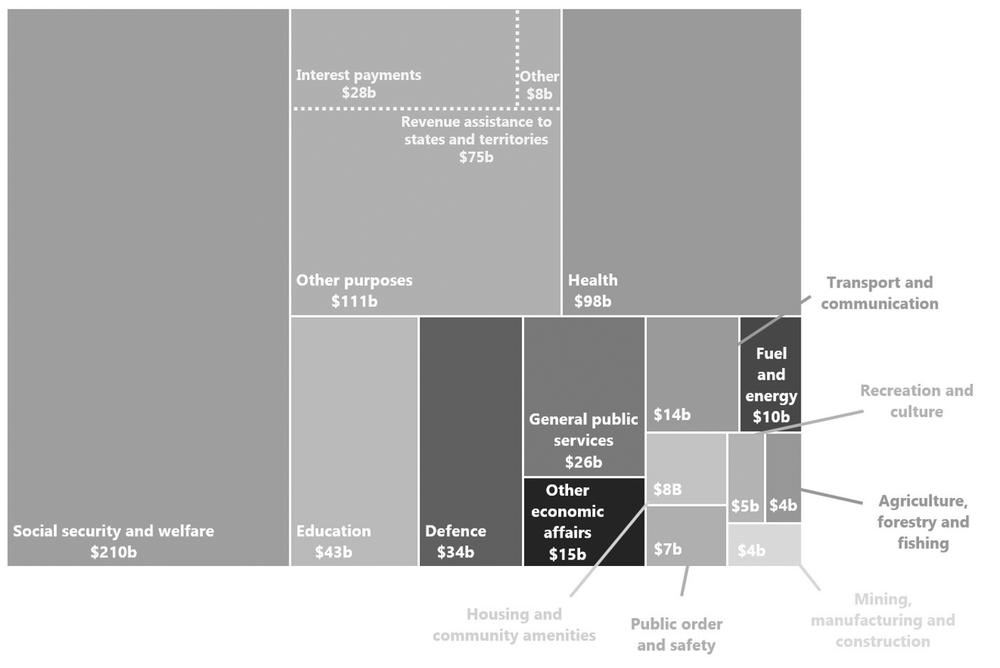

Government revenue mostly comes from various sources of taxation, as well as earnings from government businesses and investments. The major sources of taxation revenue for the federal government are personal income tax, company tax and the goods and services tax (GST). Government expenditure pays for government services and other functions of government. The largest areas of expenditure for the Commonwealth are social security (such as the aged pension), health, education and defence, which are administered by federal government departments or provided as grants to state governments. Figures 2 and 3 illustrate the distribution of federal government revenue and expenditure for fiscal year 2021/22.

The executive arm of government requires authorisation from parliament (the legislature) to ‘appropriate’ revenues to be able to spend public money. Appropriation Bills are usually passed or amended according to the rules set out in the Constitution. Threats or actions to block appropriation (or ‘supply’) have been major flashpoints in Australian political history.

When revenue does not cover expenditure, governments usually finance this gap by borrowing money, which they do by selling government bonds in financial markets (see the key economics terms box). Investors buy the bond from the government for a certain amount of money (its ‘face value’), providing what is effectively a loan to the government. The government pays the holder of the bond a fixed rate of interest (the ‘coupon’) over a set period of time (its ‘maturity’), sometimes up to 30 years.

Government debt, in the form of outstanding bonds, is a liability on the government’s ‘balance sheet’. This is a different part of the budget from its operating budget (which reports surplus and deficits over a fiscal year). The balance sheet instead measures the government’s accumulated net wealth position, and includes not just liabilities, but assets. Major government assets include physical assets, such as government-owned infrastructure, and financial assets, such as sovereign wealth funds like the Commonwealth government’s Future Fund. The ‘sustainability’ of public debt is another major area of political debate, which is usually measured in terms of the ratio of debt levels to Gross Domestic Product (GDP), or the cost of debt servicing (see the key economics terms box).

In Australia’s federal system, powers for taxing and spending are divided between Commonwealth and state governments. These powers were originally set out in the Constitution, but their interpretation has changed over time through various High Court decisions and historical events. Since the Second World War, when state government income taxation powers were ceded to the Commonwealth, Australia has had a pronounced ‘vertical fiscal imbalance’.[3]

Vertical fiscal imbalance describes the fact that the Commonwealth government has much greater revenue-raising capacity than states, which rely on a more limited set of taxes such as land tax, stamp duty and payroll tax. But state governments maintain significant responsibility for service delivery, such as hospitals, schools and public transport. Vertical fiscal imbalances make state governments reliant on grants from the Commonwealth, which are decided through political negotiation. Economic inequalities between states also create horizontal fiscal imbalances, where some states have proportionately lower revenues and higher expenditures than other states. Since the 1930s, Australia has used the Commonwealth Grants Commission to facilitate horizontal fiscal equalisation, now largely managed through a formula for allocating GST revenues to the states.

Principles of taxation

The design of a taxation system has major distributional consequences. Taxes are not only used to raise revenue, but also shape the economy and society. Beyond constitutional constraints, the relative weight given to different kinds of taxation reflects different political and economic ideas and interests.

There are five main principles that can be applied to justify or assess taxation proposals and reform: stability, progressivity, efficiency, simplicity and acceptability.

- Stability describes the capacity of taxation to reliably raise revenue for the government. But taxes can also aim to stabilise the economy itself, by automatically increasing revenue collection in times of economic growth, and decreasing revenue collection in times of economic crisis.

- Progressivity is concerned with equity, and the extent to which taxes reflect ability to pay and reduce inequality. Progressive taxes require those with higher incomes and wealth levels to pay a higher proportion of their income or wealth, while regressive taxes make those with lower incomes or wealth levels pay a higher relative share (even if their absolute contribution is lower).

- Efficiency assesses the incentives taxes send to economic activity. According to this logic, taxes should encourage economic ‘goods’ (such as productivity and innovation) and discourage economic ‘bads’ (such as financial speculation or pollution).

- Simplicity is a design feature of taxation that describes whether it can be understood and applied in a clear and consistent manner. Complex tax codes often provide more scope for tax avoidance or evasion.

- Acceptability refers to the politics and social legitimacy of taxation. Governments make political calculations about the impacts of taxation on different political constituencies, which ultimately shape how other principles of taxation are put into practice.

Budgets and politics

Government budgets are central to Australia’s political history. Budgets have been key battlegrounds for disputes over economic theory, the control of resources and the nature of sovereignty. Twice the British Crown’s representative has used their ‘reserve powers’ to dismiss a majority government, both times enforcing fiscal limits on expansionary Australian Labor Party (ALP) governments.

The first dismissal took place in the face of the Great Depression in the 1930s. Divisions within the ALP saw a split emerge between the federal Labor government, led by James Scullin and the New South Wales Labor premier Jack Lang. Scullin accepted orthodox economic advice to radically cut public spending to match falling tax receipts, a plan also accepted by the state premiers. Lang rejected the approach, prioritising public spending and instead refusing to pay interest on foreign loans.

The dispute split Labor. Lang’s supporters voted with the opposition to end the Scullin government. An incoming conservative federal government then legislated to stop Lang’s plan. Lang responded by withdrawing all New South Wales state government funds from nationally controlled banks, an action the governor believed was illegal. The stand-off saw the governor sack Lang, entrenching a decade-long split within Labor and ongoing conservative government.

When Labor returned to national office during the Second World War, it adopted a very different fiscal policy, running large deficits to fund the war effort (see the key economics terms box). After the war, it joined other countries in turning away from orthodox economics to embrace the use of deficits to support employment, an approach advocated by British economist John Maynard Keynes. Labor’s plans for postwar reconstruction and a policy of full employment (for non-Indigenous men) established a new policy norm of rising public spending that lasted until the 1970s.

A second constitutional crisis confronted the next Labor government elected in 1972, led by Gough Whitlam. Whitlam promised to expand public spending in health, education and infrastructure. But the election coincided with a new international economic crisis, which saw rapidly rising inflation alongside unemployment caused by economic stagnation, a combination called ‘stagflation’. Stagflation seemed to contradict Keynes’ theory, which suggested a trade-off between inflation and unemployment.

Labor did not control the Senate, and, as the public deficit grew, the Coalition parties refused to pass the government’s budget. Without ‘supply’, the government would no longer be legally allowed to spend money. In 1975 the governor general intervened to dismiss Whitlam, forcing an election, a decision that remains both politically and legally controversial.[4] The Whitlam dismissal profoundly shocked the Labor party, while emboldening the Coalition to campaign for budget surpluses.

The Whitlam dismissal shifted budget politics, with successive federal governments committing to fiscal discipline and ‘budget repair’. Starting with the Fraser government, the Coalition successfully campaigned against Labor as ‘economically irresponsible’ because it oversaw budget deficits. First the Fraser government, and then from 1996 and 2013 respectively, the Howard and Abbott governments each responded to deficits by creating ‘razor gangs’ or ‘Commissions of Audit’ that proposed radical cuts to public spending. In response, the Hawke–Keating Labor government of 1983–96 committed to a ‘trilogy’ of restricting taxation, spending and government debt as a proportion of GDP, a commitment reiterated by the Rudd–Gillard governments between 2007 and 2013.[5]

More recently, the rhetoric of fiscal rectitude has combined with practical commitments to deficit spending in times of crisis. Shortly after declaring himself a ‘fiscal conservative’, Rudd announced two large fiscal stimulus packages in response to the Global Financial Crisis of 2008. Immediately prior to the onset of COVID-19, Treasurer Frydenberg forecast for the Morrison Coalition government that the budget was ‘back in black’ – a budget outcome that was never realised, as the Coalition also deployed (even larger) stimulus in response to the pandemic.

The Parliamentary Budget Office

The Australian Parliamentary Budget Office (PBO) was established in 2012, implementing a commitment agreed by the ALP and the Australian Greens during the Gillard minority government. The PBO is committed to providing the parliament with ‘independent and non-partisan analysis of the budget cycle, fiscal policy and the financial implications of proposals’.[6]

The PBO, along with the Parliamentary Library, provides bureaucratic support to parliament that is independent of the executive. In practice, this means the PBO primarily supports non-government MPs, allowing opposition parties to develop costed policy alternatives. The PBO also provides reports on the fiscal implications of party policies after the election.

Parliamentary budget offices have become a common feature in many jurisdictions internationally and across Australian states. Their capacity, form and operations vary. For example, the New South Wales PBO only allows limited costings immediately before elections, requires policies to be costed and releases all advice, reducing its strategic value to opposition parties. The Australian PBO allows confidential advice across the parliamentary term.

The role of the PBO has also expanded over time as it releases regular reports on a range of budget issues. Budgets are highly political, and reports from the PBO can frame broader political debates, or shape party proposals. Sometimes, how a policy should be costed is also controversial, giving the PBO significant discretion to shape what counts as spending, debt or tax.

Public budgets and fiscal power

Public budgeting is closely connected to the development of 20th-century capitalism and its relationship with liberal democracy.[7] The power of states to appropriate and redistribute resources through fiscal policy created a sphere of public finance that was explicitly political. Citizens have used their status as taxpayers to advance claims for representation, using budgets as a tool to assert parliamentary power over the executive. Meanwhile, the sphere of private business requires the state to establish conditions for growth and profitability. Sitting at the interface of these two spheres, public budgeting became a central instrument for states to mediate tensions between the democratic demands made by citizens and the demands of businesses for profitability.[8]

Austrian political economist Joseph Schumpeter conceived of the modern state as a ‘tax state’ to emphasise the role of fiscal powers in underpinning broader state power. Schumpeter viewed public budgets as documents in which the most significant aspects of national history are recorded. Budgets were, according to Schumpeter, the ‘fiscal reflection’ of society, in which broader shifts in the political economy of capitalism could be seen.[9]

In practice, budgets are operationalised through budgetary accounting practices that record, categorise and quantify the movement of resources. While Schumpeter described budgets as a ‘collection of hard, naked facts’, the history of public budgeting reveals that fiscal and national accounting practices have changed over time. Budget rules actively shape the way governments allocate resources and design policy, and influence how citizens understand policy options. The history of the rise of the Keynesian welfare state, followed by the neoliberal restructuring of the state, reveals how changes in the accounting systems codified in budget rules underpinned major shifts in political economy.

National accounting, public budgets and Keynesian welfare

The foundations of modern public budgeting were established as part of the development of the Keynesian welfare state in the mid-20th century. As governments developed accounting practices that were distinct from the private sector, they increasingly reflected goals of macroeconomic management, as distinct from goals of business profitability.

The experience of the Great Depression, and the need to run a wartime economy during the Second World War, provided the impetus for ‘national accounts’ to represent the economic activity of national economies. National accounts came to reflect Keynesian economic categories, accounting for flows of income between households, businesses and governments within a national economy, and between different national economies.[10] Like other advanced capitalist countries, Australia developed its own system of national accounting by the end of the 1940s. The Australian Bureau of Statistics (ABS) continues to release national accounts on a quarterly basis, the headline figure of which is GDP.

National accounts crystallised the macroeconomy as an object of economic management. To facilitate macroeconomic management, budgeting practices were also changed along Keynesian lines to account for the net impact of public budgets on levels of aggregate demand (see the key economics terms box).[11] Public budgets therefore become a key tool of Keynesian demand management, where levels of spending and taxing could be calibrated to macroeconomic goals such as full employment and managing inflation. Full employment was established as a formal policy goal through a 1945 White Paper and incorporation into the central bank charter (see the key economics terms box). Depending on macroeconomic conditions, fiscal policy could either play the role of expanding (increasing spending or decreasing taxes) or contracting (decreasing spending or increasing taxes) aggregate demand.

During the long postwar boom, which extended from the 1950s to the 1970s, fiscal expansion was underpinned by the growing welfare state. Claus Offe described the postwar welfare state as a ‘peace formula’ between the demands of capitalist enterprise and mass publics.[12] In Australia’s distinctive ‘wage earners’ welfare state’, government macroeconomic management extended to the role of industrial arbitration in supporting demand through relatively high wages.[13]

Modern Monetary Theory

Are deficits really a problem? This is the question posed by followers of Modern Monetary Theory (MMT), which challenges the prevailing orthodoxy that equates balanced budgets with good economic management. Politicians often talk about the importance of budget surpluses by drawing an analogy between government budgets and household budgets. MMT argues there is one crucial difference, among many, between government budgets and household budgets: only governments can create their own money.[14]

National governments of advanced capitalist economies such as Australia are ‘monetary sovereigns’, meaning they are monopoly issuers of currency – in this case of Australian dollars. From the perspective of MMT, neither taxation nor debt is necessary to ‘pay for’ government spending. Money could instead be created and credited to the Commonwealth Treasury by the Reserve Bank of Australia, using its sovereign monetary powers. For the same reason, a national government that borrows in its own currency can never default on its debt repayments, because it has unlimited powers to create that same currency.

The upshot of MMT is that budget deficits are not by themselves a problem. What’s more, budget deficits are often necessary to ensure that a national economy makes full use of its resources. MMT followers emphasise that this does not mean there are no limits to government spending, or that taxes are unimportant for reasons other than providing revenue for governments. Instead, MMT argues that taxation can play important roles in redistributing resources, and that the real limit to government spending is not the budget balance, but rather the productive resources of the economy (which determines whether government spending will be inflationary).

Liberalisation and budget reform

Budget reform played a leading role in the dramatic upheavals of the neoliberal transformation of Australia’s and the global political economy. In the wake of the ‘stagflation’ crisis of the 1970s, governments around the world moved to liberalise markets and dismantle aspects of the Keynesian welfare state. Goals of full employment gave way to a focus on keeping inflation low. But citizens have consistently resisted efforts to privatise social policy.[15] Instead, neoliberal reform restructured public services to resemble markets.

Reflecting a growing politics of budgetary surplus,[16] neoliberal budget reform of the 1980s and 1990s centred on creating rules to limit levels of taxing, spending and government debt. In the European Union, the Maastricht Treaty implemented limits on both budget deficits and debt-to-GDP ratios, while the United States (re-)introduced its ‘debt ceiling’ rules. In the global south, international financial institutions such as the International Monetary Fund and World Bank, influenced by Washington Consensus ideas, enforced budgetary discipline through ‘structural adjustment packages’. In Australia, the pursuit of budget surpluses, such as the Hawke–Keating ‘trilogy’ commitment, have been voluntarily adopted by both sides of politics. Reforms to fiscal rules were complemented by changes to the institutional organisation of monetary policy (see the key economics terms box). Under the Howard Coalition government, Australia’s central bank, the Reserve Bank of Australia, gained formal independence and was given an explicit inflation target of 2–3 per cent.

Budget accounting categories were themselves reformed as governments were reimagined as businesses. ‘Public choice’ theories informed the adoption of private sector accounting practices, such as ‘accrual’ and ‘fair value’ accounting, within government budgets. Governments in Australia and New Zealand were at the forefront of many of these budgetary reforms.[17] The purpose of these reforms was to create a more market-like government that could ‘level the playing field’ between public and private sectors. In practice, neoliberal budget reforms provided fiscal justification for the privatisation of public assets.

Contracting out the state

Liberalisation has significantly changed how governments imagine, organise and execute their activities. Typically, this has involved incorporating aspects of markets into the organisation of state bureaucracies. Sometimes activities are reorganised under private ownership and control, as with privatisation. Even here, activities once performed by the state have to be reorganised so their governance and finance can be separated out from other state functions, a process known as corporatisation.

In other areas states continue to play an active role. Here liberalisation involves a reorganisation within the state. States began to mimic private sector management practices through new public management. State activities are assessed according to market norms through competition policy, and reorganised to separate out the functions of funder or purchaser from those of provider through marketisation. Many functions, including policy advice itself, are outsourced to private firms.

New Public Management

New Public Management (NPM) involved a significant shift in the structure of the Australian public service.[18] The Public Service had initially been built along similar lines to the Westminster model of lifelong public servants, organised into longstanding departments to provide advice that was independent of the government of the day. NPM sought to apply market principles of efficiency, breaking down the distinction between private management and public administration, to both reduce costs and to make the Public Service more responsive to ministers.

NPM was initially enacted through the Financial Management Improvement Program in 1984, which reflected similar reforms enacted by the Thatcher government in the UK. The reforms established a senior executive service that could more easily be appointed and replaced by the minister and managed through performance metrics. Other governance changes have made mergers and reorganisations of departments much more common.

NPM was designed to reorganise public sector activity by ‘managing for results’, and involved significant budgetary reform.[19] Over time this has involved devolving budget and human resource management to departments while retaining control through financial and performance metrics set centrally. The use of output and outcome measures has generally increased reporting requirements and activity. The model facilitates ‘efficiency dividends’, where across-the-board funding cuts are allocated centrally and managed locally, and the outsourcing of activities, which can be ‘purchased’ as outcomes.

Competition policy and truth in budgeting

National competition policy was formally adopted in Australia in the early 1990s, partly as an extension of NPM principles to government enterprises, following an independent inquiry commonly known as the Hilmer Review.[20] Competition policy was initially focused on improving the efficiency of government-owned enterprises, a focus partly driven by research by international organisations like the Organisation for Economic Co-operation and Development (OECD). The overarching aim of competition policy was improved efficiency. This was to be achieved through ‘competitive neutrality’. Public sector organisations were reorganised to remove potential advantages that came from public ownership, and regulation was amended to promote competition between firms rather than directly enforcing social outcomes.

Implementing competition policy was not simply a federal initiative. As most government-owned enterprises developed at the state level, it required a federal governance architecture. Most of the reforms were driven through a new body, the Council of Australian Governments (COAG), which brought together the prime minister, premiers, chief ministers and a local government representative. Over the 1990s and 2000s, all governments implemented a range of market and competition initiatives, although these varied in degree across jurisdictions. COAG was formally replaced by a new federal governance system in 2020 as part of the National Cabinet process initiated in response to COVID-19.

Changes to public budgeting enacted and extended the principles of competition policy. ‘Truth in budgeting’ reforms at state and federal level often made traditional public investments more difficult, while reducing the visibility of costs associated with public subsidies for private finance by placing them ‘off book’. The reforms encouraged forms of private financing, like private–public partnerships, and later encouraged governments to fund infrastructure through dedicated authorities set up as commercial entities, such as NBN Co. Some of these arrangements have been questioned by auditors general as sham accounting arrangements designed to conceal public finance, and most reduce accountability due to commercial-in-confidence arrangements.

Marketisation

Liberalisation initially focused on sectors within the industrial economy. Privatisations targeted infrastructure, finance and telecommunications. Deregulation targeted manufacturing and agriculture. But the most rapidly expanding areas of public expenditure are associated with the service sectors, particularly those within the welfare state. Internationally, efforts at privatisation have been far less successful within social policy where democratic resistance has been strongest.[21] Instead, social service delivery has been marketised.

Marketisation restructures social provision to mimic aspects of market exchange, while retaining key aspects of state control. This usually involves separating the roles of purchaser and provider, such that the state ‘purchases’ services on behalf of citizens from non-government service providers. Unlike conventional privatisation, marketisation was often advanced by centre-left economists who sought to combine the advantages of social priorities set by states with efficiencies and responsiveness to customers associated with markets using ‘quasi-markets’.[22]

Marketisation can take many forms, restructuring how fiscal power is exercised. Initially this might involve restructuring existing funding agreements away from ‘base’ funding models (where service providers are allocated set annual budgets) to structuring contracts based on payments for outputs. Contracts might also be subject to tender. Linking payment to outcomes or outputs is designed to create price signals.

More advanced quasi-markets involve a degree of ongoing competition. This can either involve the state directly setting the price of a service or outcome, as it does for employment services for unemployed people, or subsidising consumers while allowing the market to determine the price, as it does with general practitioner (GP) visits or child care.[23]

Not only is the state a significant source of funding in many quasi-markets, but states also regulate entry through licensing arrangements. Licensing can help maintain standards and guide workforce planning, but it can also facilitate forms of financialisation. Minimum staff ratios, for example, create incentives to train staff. But, because public funding is tied to licensing, licences can themselves be viewed as assets, allowing private firms to borrow money to expand. This was the model used by ABC Learning, which grew rapidly to become the largest private childcare provider in the world, before collapsing as its financial model came under strain.[24]

Marketisation changes how fiscal power is exercised, but does not necessarily reduce government spending. Jane Gingrich identifies ‘varieties of marketisation’ reflecting different political orientations and priorities.[25] Where states set prices and standards, marketisation can often see the state retain control through its dominant spending power. Alternatively, combining public subsidies with unregulated fees often creates dual markets, where better-off citizens can access higher quality (or higher status) services.

Unlike many other jurisdictions where direct public provision was the norm prior to liberalisation, non-government provision has long been a norm in many policy areas in Australia. But social markets have expanded and commercialised rapidly under liberalisation. By constructing social services as markets, funding arrangements become subject to commercial-in-confidence agreements, and provision is less accountable and transparent to public processes. Without close workforce and market planning, these models can also reduce institutional memory and resilience. For example, a taskforce examining the Rudd government’s stimulus response to the Global Financial Crisis found a lack of engineering and architectural knowledge within state governments compromised their ability to quickly commission school buildings.

Outsourcing policy

Outsourcing is a model of marketisation where formerly public services are provided by non-government providers. Outsourcing is usually applied to components of provision that are not considered core elements of the service: for example, cleaning or food preparation within hospitals. Where traditional public service models often themselves provided these elements of their supply chain, liberalisation has shifted them back out to the market, including for many core policy functions.

Outsourcing is not unique to the public sector. After a long period of large corporations directly controlling their supply chains to ensure access to scarce skills and resources, liberalisation has seen a shift to outsourcing across the private sector. Outsourcing potentially allows greater specialisation and flexibility. Within the public sector it also raises concerns about quality, and allegations it is used to undermine collective bargaining within highly unionised workplaces.[26]

The growing use of outsourcing for policy advice and evaluation has become more noticeable and controversial over time. Paying outside experts to evaluate policies has many advantages, but more recently some governments have used consultants to provide relatively routine policy advice. A small number of large consultancy and accounting firms, particularly the big four – KPMG, PwC, EY and Deloitte – have become increasingly powerful internationally, changing the broader policy landscape.

The use of outside market experts potentially drives innovation and global convergence, but is also associated with a hollowing out of institutional memory and declining capacity within the public sector. Governments look to consultancies to provide innovative ideas, a trend that has led to the adoption of ‘nudge units’ within and outside the state and the export of policy models through ‘policy transfer’. But consultancies often lack specific expertise or policy experience, unlike older public service models, and may be less likely to offer ‘frank and fearless’ advice given they rely financially on future government contracts.

Contesting value

Budgets make some aspects of government action visible while obscuring others. What budgets ‘see’ and what budgets ‘hide’ matter because both these seen and hidden elements shape decisions over the allocation of resources. Budget processes have also changed over time, reflecting changing economic ideas and political struggles. Models of participatory budgeting, emerging from worker movements in Brazil, even directly involve citizens in budget processes.

Governments may respond to budget constructions by moving spending off-budget so that fiscal action is hidden. Other strategies have sought to make hidden areas of current and future government spending visible, using tax expenditure and generational accounting budgetary frameworks. Feminist and ecological economists have also actively contested budget constructions, through gender budgeting and environmental valuation. These techniques attempt to ensure that undervalued aspects of the economy, such as unpaid care work or ecosystems, are ‘counted’, to promote government investment in social infrastructure and environmental sustainability.

Moving spending off-budget

Governments, faced with competing pressures to limit budget deficits and respond to demands for new forms of social spending, have increasingly moved spending ‘off-budget’. Governments have taken advantage of new, corporate sector–inspired budget rules to provide different kinds of off-budget fiscal policy. Examples include government-issued loans, such as the Higher Education Loan Program (HELP), or ‘quasi-fiscal’ special government entities, such the Australian government’s Clean Energy Finance Corporation.

Off-budget measures have increased the ‘fiscal space’ available to governments by providing an avenue for fiscal policy that is not counted in traditional measures of spending, taxation or debt. The COVID-19 response was notable in this regard, as the advanced economies matched on-budget measures such as increased unemployment benefits with substantial off-budget support, such as loan guarantees to underwrite credit markets. But, by bypassing conventional budget process, off-budget spending may reduce scope for democratic scrutiny of fiscal policy choices.

Australia’s system of income-contingent loans for higher education, now formally known as HELP but more commonly known as HECS, was an early example of moving spending off-budget. HECS was introduced in 1989 to manage the reintroduction of university fees by the Hawke Labor government after a period of free education. From a budgetary perspective, when a student enrols in university, the Commonwealth government transfers the ‘student contribution’ to the university, and creates a loan that the student must repay if and when their income reaches a certain threshold; payment is collected by the Australian Taxation Office. Because HECS is delivered as a loan, neither the initial advance nor repayments are counted by the government as on-budget expenditure or revenue.

Moving university funding off-budget has not totally evaded political debate. As a loan, HECS is accounted for as an asset on the federal government’s balance sheet. Contestation has emerged over the ‘fair value’ of HECS assets – an estimate of how much the government’s HECS loan book could be sold for on the market – because income-contingency means that some student debts are unlikely to be repaid. Governments have come under pressure to increase this fair value by unwinding the concessional elements of HECS, such as reducing repayment thresholds, or increasing interest rates.[27]

The use of ‘investment’ concepts from private accounting in the public sector has facilitated various innovations in social policy. At one end of the spectrum, social impact bonds reframe social spending as a form of private investment. By purchasing the bond, private investors (whether for-profit or philanthropic) provide up-front capital to non-government organisations to deliver social programs. Investors are then repaid by governments if the program reaches the metrics for success set out in the contract. The bonds represent a contingent liability for governments, rather than a fiscal cost.

State governments in Australia have been global pioneers in the development of social impact bonds, which have been developed to fund family restoration programs for children in foster care, or anti-recidivism programs for people who have spent time in prison. Social impact bonds have been criticised for privatising the benefits of successful programs, socialising risks of failure with governments, and individualising solutions to collective social problems.[28]

At the other end of the same spectrum is the idea of a ‘social investment state’. Developed most comprehensively in northern Europe, but recently experimented with in New Zealand, the social investment state reframes conventional government spending such as on education and housing as investments in citizens’ futures, not fiscal costs. Rather than seeking private sources of capital, social investments deliver ‘returns’ to the state in the form of higher future tax receipts or avoided future fiscal costs of health care or unemployment.[29]

Tax expenditures and gender budgeting

Public budgets are contested by both critics and supporters of markets. Critical accountants have highlighted how market models are applied asymmetrically to state budgets,[30] while feminist and ecological economists have criticised how public and private finance ignores and obscures unpaid labour and natural wealth. These criticisms have led to alternative budgeting tools, many of which have been incorporated into Australia’s budgeting processes.

One of the most important asymmetries of public budgeting is the difference in how taxation and spending are treated. Liberalisation has led to an increase in so-called ‘hidden welfare’, where governments support actions or actors through tax exemptions rather than direct spending. While tax concessions have the same fiscal and distributional impacts as spending programs, and thus reflect a similar exercise of fiscal power, they appear to reduce the fiscal size of the state by reducing tax receipts, rather than adding to spending. Economists have argued tax concessions should instead be treated as a form of expenditure.[31]

Following this economic logic, the Hawke Labor government implemented a Tax Expenditure Statement in the 1980s. Labor has capitalised on this equivalence, using funds raised by ending some tax concessions to fund expanded social spending on family benefits and health care. More recently the Turnbull Coalition government changed the statement’s name to the Tax Benchmarks and Variations Statement, downplaying the extent to which tax concessions can be equated to spending.

Australian and New Zealand feminists have also led international debates over valuing women’s paid and unpaid work.[32] Australia adopted gender budgeting in the 1980s as a formal tool for evaluating the differential impacts of policy on men and women.[33] Gender budgeting is now widely used internationally, although it is no longer formally required within Australian budgeting processes. More recently, feminist economists played an important role in equal pay cases, highlighting how wage systems have historically undervalued feminised work, such as social care, and providing tools to correct gender bias.[34]

Environmentalists have also targeted budgeting to challenge extractive economic models. This includes efforts to include the ecological costs of economic activity, such as through the Genuine Progress Indicator. Quantification of ecological harm is controversial, but can be an effective means to influencing policy processes. Environmentally focused budgeting tools intersect with efforts to quantify unpaid social labour, and to focus budgeting on ‘wellbeing’ or ‘happiness’, rather than economic growth, an approach that has begun to influence the Australian treasury’s budgets and intergenerational reports.

Forecasting the long-term

The politics of budget processes is highlighted by the growing importance of forecasting over long time horizons, well beyond standard 4-year forward estimates. Generational accounting was developed across the 1980s and 1990s by economists committed to limiting fiscal expansion. Versions of this practice have since been embraced across much of the world, including in Australia through truth in budgeting reforms by the Howard Coalition government, which require the publication of an intergenerational report at least every five years.

Generational accounting forecasts typically cover 40 years into the future. Forecasts tend to project increasing costs of social services and payments as a result of an ageing population, but stable or declining tax receipts. Such calculations implicitly assume that while current social policies (such as the retirement age for the aged pension) will remain constant, governments will change taxation policy to ensure that tax receipts do not rise as a proportion of GDP (as would otherwise automatically occur through processes such as ‘bracket creep’).[35] Asymmetry often leads to predictions of growing budget deficits, which are used to justify forms of austerity, reflecting a desire to minimise tax burdens on future generations. In Australia, intergenerational reports have consistently predicted rising living standards and per capita incomes, despite budget deficits.

Surprisingly similar techniques have been used to model the economic impacts of climate change. The Stern Review in the UK and Garnaut Report in Australia are two of the most prominent examples of government-commissioned reports on the economics of climate change. The reports found modest returns on climate action, meaning action avoided greater losses over a 100-year period than it initially cost. These findings also informed the 2010 intergenerational report, reflecting the intersection of different forecasting approaches.

Forecasting is always a difficult exercise because it requires comparisons between current and future generations. In climate forecasting, small differences in the ‘discount rates’ used to make such comparisons can make big differences in conclusions about optimal levels of climate action over long time horizons. Climate uncertainties also create unique challenges, as dynamics such as climate tipping points, and outcomes such as species extinction, are difficult to reconcile with cost–benefit analysis frameworks.[36]

Conclusion

Sociologist Rudolf Goldscheid famously described public budgets as the skeleton of the state stripped of all misleading ideologies.[37] This statement helped inspire a scholarly field of fiscal studies, but may have underestimated the many skeletons of public budgeting. Far from being neutral or dry documents, public budgets are political instruments for redistributing resources, and power, in society.

The politics of budgets have brought down governments and driven economic reform. Public budgets reflect broader political struggles over the rise of Keynesian welfare and then neoliberal restructuring. Budget rules do not simply account for government revenue and expenditure, but shape how governments design policy, reorganising the very structure of the state.

Budget practices are also sites of contest. Political actors attempt to advance their goals by either omitting or counting fiscal action and its economic, social and environmental impacts. Budgets play a central role in mediating different political choices that society can make to enact competing visions of the future. Expanding participation in budget processes is therefore essential for strengthening democracy.

References

Brenton. S. (2016). The politics of budgetary surplus. London: Springer.

Castles. F. (1985). The working class and welfare: reflections on the political development of the welfare state in Australia and New Zealand, 1890–1980. Sydney: Allen & Unwin.

Christensen, M., S. Newberry and B.N. Potter (2019.) Enabling global accounting change: epistemic communities and the creation of a ‘more business-like’ public sector. Critical Perspectives on Accounting. 58: 53–76.

Cortis, N., and G. Meagher (2012). Recognition at last: care work and the equal remuneration case. Journal of Industrial Relations, 54(3): 377–85.

Deeming, C., and P. Smyth (2015). Social investment after neoliberalism: policy paradigms and political platforms. Journal of Social Policy, (2): 297–318.

Ellwood, S., and S. Newberry (2007). Public sector accrual accounting: institutionalising neo‐liberal principles? Accounting, Auditing and Accountability Journal, 20(4): 549–73.

Fenna A (2019). The centralisation of Australian federalism 1901–2010: measurement and interpretation. Publis, 49(1): 30–56.

Gingrich, J.R. (2011). Making markets in the welfare state: the politics of varying market reforms. Cambridge, UK: Cambridge University Press.

Goldscheid, R. (1917). Staatssozialismus oder Staatskapitalismus. Ein finanzsoziologischer Beitrag zur Lösung des Staatsschulden-Problems. Anzenburger-Verlag: Vienna and Leipzig.

Guthrie, J., L. Parker and L.M. English (2003). A review of new public financial management change in Australia. Australian Accounting Review, 13(30): 3–9.

Harvie, D., G. Lightfoot, S. Lilley and K. Weir (2020). Social investment innovation and the ‘social turn’ of neoliberal finance. Critical Perspectives on Accounting, 79: 102248.

Hocking, J. (2016) .The Dismissal dossier updated edition: everything you were never meant to know about November 1975. Melbourne: Melbourne University Publishing.

Humphrys, E. (2019). How labour built neoliberalism: Australia’s accord, the labour movement and the neoliberal project. Brill: Leiden and Boston.

Jessop, B. (2016). The state: past, present, future. Cambridge, UK: Polity Press.

Johnston, J. (2000). The new public management in Australia. Administrative Theory and Praxis, 22(2): 34568.

Kelton, S. (2020). The deficit myth: modern monetary theory and the birth of the people’s economy. New York: PublicAffairs.

Le Grand, J., and W. Bartlett, eds (1993). Quasi-markets and social policy. London: Palgrave Macmillan.

Meagher, G., Stebbing, A., and Perche, D. (2022). Designing Social Service Markets: Risk, Regulation and Rent-Seeking. Canberra: ANU Press.

Newberry, S., and D. Brennan (2013). The marketisation of early childhood education and care (ECEC) in Australia: a structured response. Financial Accountability and Management, 29(3): 227–45.

O’Connor, J. (1973). The fiscal crisis of the state. New York: St. Martin’s Press.

Offe, C. (2018) Contradictions of the welfare state (ed. J. Keane). Boca Raton, FL: Routledge.

Parliamentary Budget Office (2021). 2021–22 Budget at a glance. Parliament of Australia. https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Budget_Office/Publications/Chart_packs/2021-22_Budget_at_a_glance

Pierson, P. (2001). Coping with permanent austerity welfare state restructuring in affluent democracies. In P. Pierson, ed. The New Politics of the Welfare State, 410–456. Oxford, UK: Oxford University Press.

Rollings, N. (1988). British budgetary policy 1945–1954: a ‘Keynesian revolution’? Economic History Review, 41(2): 283–98.

Schumpeter, J.A. (1991). The crisis of the tax state. In Richard Swedberg, ed. The Economics and Sociology of Capitalism, 99–140. Princeton, NJ: Princeton University Press.

Sharp, R., and R. Broomhill (2002). Budgeting for equality: the Australian experience. Feminist Economics, 8:1, 25o–47.

Spies-Butcher, B., and G. Bryant (2018). Accounting for income-contingent loans as a policy hybrid: politics of discretion and discipline in financialising welfare states. New Political Economy, 23(6): 768–85.

Spies-Butcher, B., and A. Stebbing (2019). Mobilising alternative futures: generational accounting and the fiscal politics of ageing in Australia. Ageing and Society, 39(7): 1409–35.

Stebbing, A., and B. Spies-Butcher (2010). Universal welfare by ‘other means’? Social tax expenditures and the Australian dual welfare state. Journal of Social Policy, 39(4): 585–606.

Suzuki, T. (2003). The epistemology of macroeconomic reality: the Keynesian revolution from an accounting point of view. Accounting, Organizations and Society, 28(5): 471–517.

Teicher, J., B.V. Gramberg and P. Holland (2006). Trade union responses to outsourcing in a neo-liberal environment: a case study analysis of the Australian public sector. Asia Pacific Business Review, 12(2): 243–56.

Wagner, G., and M.L. Weitzman (2016). Climate shock: the economic consequences of a hotter planet. Princeton, NJ: Princeton University Press.

Waring, M. (1988). If women counted: a new feminist economics. San Francisco: Harper & Row.

About the authors

Ben Spies-Butcher is Associate Professor of Economy and Society in the Macquarie School of Social Sciences at Macquarie University. His research explores the politics and economics of public finance and the welfare state. Ben is also co-director of the Australian Basic Income Lab, a collaboration between Macquarie University, the University of Sydney and the Australian National University.

Gareth Bryant is Senior Lecturer and Australian Research Council DECRA Fellow in the Discipline of Political Economy at the University of Sydney. His research explores how public policy and public finance can create more sustainable, equal, and democratic economies. Gareth is also economist-in-residence at the Sydney Policy Lab and co-editor of Progress in Political Economy (PPE).

- Spies-Butcher, Ben and Gareth Bryant (2024). Public budgeting and resource management. In Nicholas Barry, Alan Fenna, Zareh Ghazarian, Yvonne Haigh and Diana Perche, eds. Australian politics and policy: 2024. Sydney: Sydney University Press. DOI: 10.30722/sup.9781743329542. ↵

- Goldscheid 1917. ↵

- Fenna 2019. ↵

- Hocking 2016. ↵

- Humphrys 2019. ↵

- Section 64B of the Parliamentary Service Act 1999. ↵

- Jessop 2016. ↵

- O’Connor 1973. ↵

- Schumpeter 1991 [1918]. ↵

- Suzuki 2003. ↵

- Rollings 1988. ↵

- Offe 2018 [1984]. ↵

- Castles 1985. ↵

- Kelton 2020. ↵

- Pierson 2001. ↵

- Brenton 2016. ↵

- Christensen, Newberry and Potter 2018. ↵

- Johnston 2000. ↵

- Guthrie, Parker and English 2003. ↵

- Johnston 2000. ↵

- Pierson 2001. ↵

- Le Grand and Bartlett 1993. ↵

- Meagher et al. 2022. ↵

- Newberry and Brennan 2013. ↵

- Gingrich 2011. ↵

- Teicher, Gramberg and Holland 2006. ↵

- Spies-Butcher and Bryant 2018. ↵

- Harvie et al. 2020. ↵

- Deeming and Smyth 2015. ↵

- Ellwood and Newberry 2007. ↵

- Stebbing and Spies-Butcher 2010. ↵

- Waring 1998. ↵

- Sharp and Broomhill 2002. ↵

- Cortis and Meagher 2012. ↵

- Spies-Butcher and Stebbing 2019. ↵

- Wagner and Weitzman 2016. ↵

- Goldscheid 1917. ↵