25 The process: from generating to using customer insights

Learning Objectives

By the end of this chapter, the student must be able to:

- identify the steps in generating and using customer insights

- differentiate between traditional research findings and the concept of actionable insights

The traditional process of marketing research is based on the initial step of ‘defining the problem’ or clearly stating the research question. In a few, rare cases scholars have also stressed carrying out a cost-benefit analysis to see if expensive marketing research is at all needed. In comparison, managers who believe in the concept of customer insights claim that exploring available data actually helps to trigger questions and related issues[1]. Further analysis and interpretation of multi-sourced data is required to clearly articulate the goal in mining data. It is only when meaningful actions are taken as a result of an emerging insight, that problems are solved.

This chapter presents an 8-step process in developing a strategy around customer insights. This involves planning to generate and then using customer insights to meet organisational goals. These steps have been collated after going through practitioners’ experiences and suggestions made by academics. Each step is discussed in detail below.

Step 1: Recognition and commitment to the ‘customer insights’ concept

As with many organisational strategies, the chance of a successful customer insights program rests with the management. If the top management recognises the value in developing a customer insights program – and then commits resources to it – the initiative can take off. Traditionally, managers are more familiar with the concept of marketing research. However, if business leaders can take the time (and energy) in learning about the benefits of an insights approach, and guide their organisation towards treating data – especially the one which is already available – as a valuable asset, then the first step in the launch of a customer insights program has been taken. More importantly, the insights department is not a stand-alone unit in the organisation. In fact, high-performing companies would ensure that leaders from the insights team are involved in all stages of strategic planning in the firm.

Step 2: Identify various ‘sources of data’ – internal and external to the firm

An organisation generates data continuously – yet, managers may not always be aware of its utility. A record is created every time there is a transaction made or a customer query received. If a frontline manager wants to review the efficiency of her team’s customer-service operations, it is quite possible to tap into various sources of data being generated and stored, internally. A 360o view could reveal that data from in-store cameras/sensors, online queries, telephone calls, and product returns is useful. Moreover, the company’s frontline staff – who are interacting with customers directly – could supplement the data with their own experiences[2].

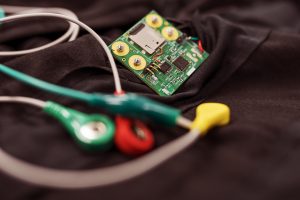

Similarly, managers can think creatively on the sources of information externally available. Wearable technologies capture videos of consumers using products in real time (reference: https://www.warc.com/newsandopinion/news/unilevers-path-to-innovative-insights/36906). Moreover, data from social media carries a wealth of information in text, video, and image formats. Such information is based on casual conversations amongst account-holders and thus seen to be more ‘reliable’ than made-up responses to a formal survey. Besides this, information from the Australian Bureau of Statistics, the Bureau of Metrology, and regular reports from leading firms, such as the ANZ-Roy Morgan (e.g., the Consumer Confidence Index) may assist business managers in analysing a situation.

A word of caution: managers could end up with piles of data on their desks which is not useful. It also does not help if a statistician runs dozens of hypothesis tests and churns out results for managers to ‘see’. The trick is to design a data collection-collation strategy in which critical information can be sifted – from tons of material – made available to employees, and eventually used to implement specific strategies.

Step 3: Build an ‘Insights Team’ with different skills and capabilities [3]

A customer insights team must include team members with different skills and capabilities. For example, a product manager, a business analyst, a statistician, an IT person, a data architect/scientist, and a graphic designer ould be a team for working on a particular project. Such an approach to carry out a ‘research’ activity may require a cultural and a mindset change. This could be new territory for many traditionalists. Introducing employees to such an innovative technique could be undertaken with a multifaceted approach – training, role modeling by leaders, incentives, and metrics to reinforce behaviour.

Building the right team is a critical step in designing a strategy for customer insights. Big data, information, and technology are here to stay. Instead of going for a major overhaul organisations are suggested to keep working on creating a culture towards being flexible and nimble. As more employees are trained and exposed to the benefits of using existing data, organisations can build their superior capabilities which will prove to be a decisive competitive asset.

Step 4: Use existing tools/develop your own tools for managing data

With the amount of digital information which is available these days, companies need reliable tools to ensure that relevant information is accessible to managers. There are some tools that are free of cost or reasonably priced which can easily be employed even by small businesses. These include YouTube Analytics, Google Analytics, Facebook Audience Insights, Twitter Analytics, and other platforms to measure social media activity. Of course, there are many other software and platforms available for managers to choose from. The final decision would depend on the firm’s needs as well as the costs involved in using any of these tools.

Depending on the IT capabilities of the firm, it may be feasible to design one’s own data platform. The goal of such a platform, designed and built in-house is to empower individual employees to access data, analyse data themselves, and then use this data to make decisions. Such a platform must be easy to access and use. If there are many barriers (such as digital access or high-level skill set required), then the usability of such a platform reduces. A data management platform should be user-friendly (for employees) as well as user-centric.

Step 5: Interpret data – data analyst or …?

While businesses regularly looked for skilled data analysts, there is another concept that is proving to be a useful one. Data analysis is too important to be left to only one person – or a group of people with technical skills. Everyone on the team must have enough training to be able to understand data. Business executives agree that a lack of skills in data analysis and analytics prevents them from making key decisions based on data analytics. That is why it is important to carry out an audit of the basic skill levels of current team members and then provide them with training and resources so they can confidently analyse datasets, without relying on someone to churn out numbers for them[4].

Step 6: Identify meaningful insights

While there are some people who still insist that findings and insights are the same things, a growing number of practitioners are highlighting the differences between the two concepts. The table below highlights the differences between research findings and insights.

Table: Differences between ‘Research Findings’ and ‘Customer Insights’[5]

| Research Findings | Customer Insights |

| “a piece of information that is discovered during an official examination of a problem situation” (Cambridge Dictionary) | “a clear, deep and sometimes sudden understanding of a complicated problem or situation” (Cambridge Dictionary) |

| Usually based on a single source of data, such as a survey | Based on multiple sources of data, e.g., internal records, social media, etc. |

| Hard facts | Meaningful, fact-based story |

| Clearly visible (e.g., correlation is 0.7) | Not so obvious; requires intense exploration; hidden pattern in the data |

| All analysis yields ‘findings’ | Not all data synthesis/exploration results in ‘insights’ |

| Focus is on data analysis and hypothesis-testing | Focus is on the integration of both creative and analytical thinking |

| Could be interesting, but trivial | Informative, actionable |

| Nice-to-know | Need-to-know |

| Mostly understandable to experts with statistical know-how | Understandable to employees |

Example: https://www-warc-com.ezproxy.uws.edu.au/content/article/unilever-putting-the-consumers-voice-through-out-the-business/135005

So, what does it mean to have an actionable insight? Here is an example: In 2018, Unilever launched its Digital Voice of the Consumer (DVOC) program to understand better what quality means to consumers. DVOC helps gather the reviews and feedback people share with Unilever’s Consumer Engagement Centres as well as on other public platforms. The DVOC dashboards consolidate and process data from social media, news, forums, customer call centres, e-commerce sites, and experts’ inputs (via a dashboard app).

The immense value from DVOC came into effect during the coronavirus outbreak globally. Unilever needed to conduct rapid market research globally to understand the new struggles faced by its consumers. A traditional approach to market research with surveys and focus groups would have taken a long time, and perhaps not yielded accurate information. By carefully analysing social media conversations, a hand sanitiser brand team saw that consumers were confused by different descriptions of alcohol content on the product’s labelling. The brand team was able to identify this piece of information as an ‘actionable insight’. They quickly issued instructions to their support teams and helped adapt messaging to better clarify the information to consumers, in a bid to help reduce any confusion about the brand.

Step 7: Communicate via data visualisation[6][7]

Data visualisation means drawing graphic displays to show data. Previously, this was a skill that was considered to be a ‘nice-to-know’ skill. Now it has become a ‘must-have’ skill as communicating with various audiences requires the use of easy-to-understand visuals.

A visualisation, at best, is a visual explanation. It uses the brain’s visual perception system to help us understand a large data set, a set of relationships, or spatial relationships. Visualising data allows us to:

- analyse and understand data better

- move past two-dimensional flatland lists

- encourage the exploration of data complexity in engaging, interesting, and compelling ways

- illustrate the stories behind the data

Better hardware has meant more precise reproduction, better color (including alpha-blending), and faster drawing. Better software has meant easier and more flexible drawing, consistent themes, and higher standards. Computer scientists have become much more involved, both on the technical side and in introducing new approaches.

Including data visualisations in your collections has the potential to increase the reuse, discovery, and connectivity of your research data. A good visualisation should:

- show the data

- induce the viewer to think about the substance rather than about the methodology

- avoid distorting what the data have to say

- present many numbers in a small space

- make large data sets coherent

- reveal the data at several levels of detail from a broad overview to the fine structure

Step 8: Incorporate ‘actionable’ insights into developing strategies

Many proponents of ‘customer insights’ discipline assert that the process should lead to the emergence of ‘actionable’ insights. Actionable insights are conclusions drawn from data that can be turned directly into an action or a response. Actionable insights are an outcome of extensive data and information-driven analysis that allows an organisation and its employees to make informed decisions. A bulk of the data could be non-insightful or general information. This could be information that is well-established and recognised. However, it is those valuable nuggets hidden within datasets, which when mined, shared, and understood across the organisation may reveal certain ‘insights’ which could drive action. Actionable insights translate into concrete actions that lead to modification and action.

Source: Digital Garage[8]

References:

Barton, D., & Court, D. (2012). Making advanced analytics work for you. Harvard business review, 90(10), 78-83.

https://online.hbs.edu/blog/post/analytics-team-structure

https://www.thinkwithgoogle.com/intl/en-ca/future-of-marketing/digital-transformation/marketing-data-analysis-infographic/

https://www.warc.com/newsandopinion/news/unilevers-path-to-innovative-insights/36906

https://www-warc-com.ezproxy.uws.edu.au/content/article/event-reports/unilevers-eight-tips-for-method-innovation/107930

https://www.unilever.com/news/news-search/2020/how-your-product-reviews-are-shaping-our-brands/

https://www-warc-com.ezproxy.uws.edu.au/content/article/unilever-putting-the-consumers-voice-through-out-the-business/135005

- Rogers, C 2017, Marketing insight teaming up to drive better business, Marketing Week, viewed 21 March 2022, <https://www.marketingweek.com/marketing-insight-teaming-up-to-drive-better-business/>. ↵

- Barton, D & Court, D 2012, 'Making advanced analytics work for you', Harvard Business Review, vol. 90, no. 10, pp. 78-83, viewed 22 March 2022, <https://hbr.org/2012/10/making-advanced-analytics-work-for-you>. ↵

- Stobierski, P 2021, How to structure your data analytics team, Harvard Business School Online, viewed 22 March 2022, <https://online.hbs.edu/blog/post/analytics-team-structure>. ↵

- Think with Google 2017, How to make everyone on your team a data-savvy marketer, viewed 22 March 2022, <https://www.thinkwithgoogle.com/intl/en-ca/future-of-marketing/digital-transformation/marketing-data-analysis-infographic/>. ↵

- Doing Data n.d., Data, information or insight?, viewed 22 March 2022, <https://www.doingdata.org/blog//difference-among-data-information-and-insight>. ↵

- Unwin, A 2020, Why is data visualization important? What is important in data visualisation?, viewed 16 March 2022, <https://hdsr.mitpress.mit.edu/pub/zok97i7p/release/3>. ↵

- Australian National Data Service n.d. Data visualisation, viewed 16 March 2022, <https://www.ands.org.au/working-with-data/publishing-and-reusing-data/data-visualisation>. ↵

- Digital Garage 2013, Breaking down your data for insights, viewed 22 March 2022, <https://www.youtube.com/watch?v=PurEIh0qkno>. ↵