14 Activity Based Costing

Stijn Masschelein

In this chapter, I introduce the cost accounting approach that is often seen as the first modern cost accounting approach, Activity Based Costing. I will introduce activity based costing and show how and when more detailed cost accounting systems provide useful insights for better decision making. The next chapter focuses on a specific cost, the cost of unused capacity, and its treatment in activity based costing systems. Strategic investments such as machines or highly skilled employees are often not used at full capacity and activity based costing is well equipped to quantify the cost of unused capacity.

Cost Object

The goal of every cost accounting system is to allocate costs to different cost objects, which can be everything that an organisation wants to know the cost of. For instance, car manufacturers are interested in the unit cost of producing one car [1] but they will also be interested in all the costs that are assigned to one specific car brand [2]. If an organisation has both businesses and individuals as customers, it will be interested whether one class of customers causes higher costs than the other. Or the organisation may be interested in the costs absorbed by a department or the costs caused by one of its suppliers. For different decisions, different cost objects will be relevant. To set the price of a car, we need to know the cost of producing one car but to decide whether to discontinue producing a certain car brand, we need to treat the brand itself as the cost object.

Direct and Indirect Costs

All cost accounting systems distinguish between direct and indirect costs where a direct cost is a cost that can be immediately assigned to a cost object. For instance, the cost of a tutor can be immediately assigned to a unit. On the other hand, I am paid a salary to teach and do research. My salary can not immediately be assigned to this unit because my salary pays for more than one unit and for the non-teaching part of my job as well. We will have to find a way to quantify how much of my salary should be assigned to the unit. For instance, I could make a guess of how much of my time is spent on the unit [3]. As a result, whether a cost is direct or indirect depends on the cost object that we are interested in. For instance, if we want to determine the cost per student, the cost of the tutor will be an indirect cost because a tutor will typically deal with multiple students at the same time. It is theoretically possible, to track exactly every second that a tutor spends on a specific student, maybe with some eye tracking technology. However, the cost of tracking the time of the tutor to the second would be uneconomical. Whether a cost should be considered direct or indirect is thus also a practical decision that depends on the transaction cost of tracking the cost usage. Sometimes, it is just not worth the effort to trace a cost directly to the cost object that we are interested in.

If we cannot directly trace a cost directly to a cost object, that means that we need to estimate the indirect cost per object. In my previous example, to estimate the cost of a tutor per student, we can divide the cost of the tutor by the number of students. This is the typical, traditional volume based cost allocation because we use the volume (number of students) to allocate the indirect cost. This approach gives the average cost per student which is appropriate if either that is what we are interested in or if all students need approximately the same level of attention. However, if the university is interested in knowing the cost of different types of students and those students need different levels of attention by the tutors this average, volume based approach is no longer appropriate [4]. This is where Activity Based Costing comes in.

Activity Based Costing

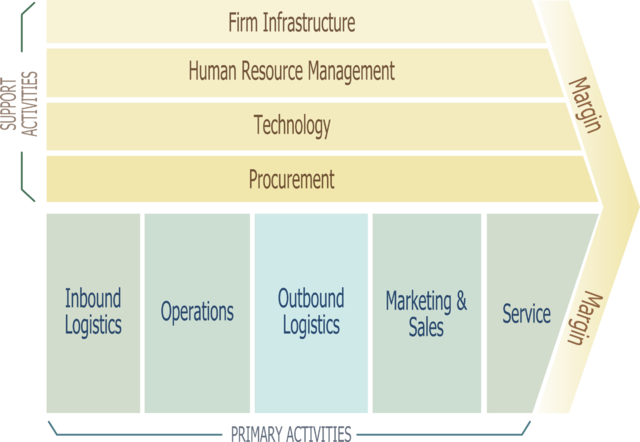

Activity Based Costing aims to make the allocation of indirect costs more methodological by focusing on what the firm is actually doing. The first step of an activity based costing analysis should be to perform an activity analysis. A firm can interview employees, observe them, and analyse internal data to find out the main activities in the organisation. A prototypical example for a manufacturing firm is given in Figure 14.1 below which makes a distinction between five primary activities that are supported by four other activities.

From Resources to Activities

For a lecturer, the important teaching activities are unit preparation, lecturing, exam design, exam marking, assignment marking, and general administration. With Activity Based Costing, a cost accountant wants to allocate the salary of the lecturer to these activities according to a resource driver. The most straightforward way is to use (or estimate) the hours the lecturer spends on these different activities and calculate the percentage of time that a lecturer spent on these six different activities. I made some guesses for how much time I spend on preparing and teaching my units [5] as a lecturer and I show them in Table 14.1.

| Activities | Lecturer (Indirect) | Tutors (Direct) |

|---|---|---|

| Unit Preparation | 15 % | 22 hours |

| Lecturing | 6 % | 44 hours |

| Exam Design | 1 % | |

| Exam Marking | 2 % | 15 minutes / student |

| Assignment Marking | 3 % | |

| Administration | 3 % |

I contrast the indirect lecturer costs with the direct tutor costs for my undergraduate unit which has two weekly 2-hour workshops for eleven weeks. The university allocates one hour of preparation for every two hours of actual teaching. The cost of marking by tutors can be immediately allocated to a student because the university policy is that marking should take no more than 15 minutes per exam paper. From this description, you can see that it is easy to allocate the cost of the tutors directly to the unit. We just need to multiply the cost per tutor hour [6] by the total hours the tutors dedicate to the unit. So, the intermediate step of allocating the cost of the resource (tutors) to the activities is not necessary for a direct cost.

From Activities to Cost Objects

I am coordinating and teaching two units per year, an undergraduate unit and an honours unit [7]. Table 14.2 has more information on the two units which we use to allocate the cost of the lecturer activities to the two cost objects, i.e. the undergraduate unit and the honours unit.

| Activity Driver | Undergraduate | Honours |

|---|---|---|

| Number of Students | 100 | 15 |

| Teaching hours per week | 7 | 3 |

| Preparation Load | 40% | 60% |

| Final Exam | Yes | No |

| Written Assignments | 24 per semester | 7 per student |

In the honours unit, I am required to present the latest research in accounting and finance and thus the unit needs regular updating. I estimate that I spend about 60% of my preparation time on the honours unit and 40% on the undergraduate unit (see Table 14.2). As a result, 9% [8] of the lecturer cost should be allocated to the honours unit and 6% [9] to the undergraduate unit. In the undergraduate unit, I lecture one hour per week and run three two-hour workshops per week for seven weeks in total. In the honours unit, I teach a three-hour research seminar. This amounts to spending 4.2% [10] of my total time teaching in the undergraduate unit and 1.8% [11] in the honours unit.

The exam design and exam marking activities are easier to allocate because only the undergraduate unit has a final exam. The written assignments in the undergraduate unit are written reports written by groups of 4 or 5 students. Over the course of the semester, there are 24 group assignments that need marking. In the absence of a final exam, the honours students have continuous individual evaluation in the form of seven individual assignments. Over the course of the semester, there are 105 [12] assignments that need marking. Thus, assignment marking for the undergraduate unit takes up 0.56% [13] of my time and marking for the honours unit takes up 2.44% [14] of my time. Notice that this calculation assumes that every assignment takes about the same amount of time to mark [15]. Finally, I allocate the administration cost by the number of students [16].

| Activities | Undergraduate | Honours |

|---|---|---|

| Unit Preparation | 6 % | 9 % |

| Lecturing | 4.2 % | 1.8 % |

| Exam Design | 1 % | – |

| Exam Marking | 2 % | – |

| Assignment Marking | 0.56 % | 2.44 % |

| Administration | 2.61 % | 0.39 % |

| Total | 16.37 % | 13.63 % |

Initial Conclusions

While the calculations are instructive, there are broader lessons to be drawn from this exercise. First of all, the calculations show why activity based costing can be valuable. If I would have used the number of students (i.e. volume based cost accounting) to allocate costs, the undergraduate unit would have received more of the costs and the honours a lot less. The costs for each of the activities in Table 14.3 differ considerably from the 15-100 split in students.

Nevertheless, if the university would have decided that each unit takes about the same amount of time from the lecturer with a small adjustment for units with larger students, they would end up roughly in the same place as the totals of 16% and 14%. After doing an exercise like this the university’s cost accountant might reasonably decide that they would not repeat this exercise for each lecturer but it would be too time consuming. Notice that I could provide such a detailed breakdown because the estimates are based on my actual work and thus my specific knowledge.

Extensions

The advantage of the activity based cost approach is that we can be more discerning in which costs are treated as if they are varying. Not necessarily varying based on the volume of production but varying based on the activities that the organisation undertakes. In the example above, some costs vary based on the number of students, some based on the type of unit, or some depend on the number of assignments. We have seen in the chapter on variance analysis and the flexibility budget that we can use the distinction between variable and fixed costs to answer certain what-if questions. The flexible budget is the answer to the question “What if we had made the planned budget for exactly the volume that we actually observe at the end of the period?” By treating more costs as potentially varying in activity based costing, we can answer a broader set of questions. For instance, what are the cost savings of decreasing the number of assignments? In other words, activity based costing allows the decision makers in the organisation to quantify the impact of a broader set of decisions.

More generally, in activity based costing, we allow for costs to vary at different levels. For instance, the number of students is the traditional, volume level in the cost hierarchy. In a manufacturing firm, the number of units produced is at that same level but some costs vary at a different level. For instance batch level costs are not associated with a unit of production but with a production run or an order. Machine set-up costs between production runs and administration and handling costs of customer orders are examples of batch level costs. R&D costs and marketing costs are examples of product level costs and are associated with a specific product line. Other costs can vary by the supplier, or by customer, or by the plant facility.

Value of Activity Based Costing.

As always, the value of activity based costing for a specific form will be a trade-off between the benefits and the costs. If the firm has highly effective technology to track all costs [17], it is able to directly assign costs to cost objects and it does not need activity based costing. In other words, only if the indirect costs are sufficiently large will activity based costing be advantageous to the firm. Even with a lot of indirect costs, when there are only a few resources, a few activities, or a few cost objects, activity base costing may be of limited value. Activity based costing will be of most value when a firm offers a large diversity in products or services, when these services consume different activities at a different rate, and the activities draw differently from the resources. In the example, above if a unit has no exam, there will be no costs allocated from the activity exam marking. However, if all units have an exam, we could as well split the costs of exam marking based on the volume, i.e. the number of students. If there is not much difference in the use of activities and resources, it will not make a large difference in cost calculations when we make a distinction between activities. In other words, when the cost objects are homogeneous, the distinctions that activity based costing makes are of little value. In the example above, if a lecturer puts the same amount of preparation work in a postgraduate unit as in an undergraduate unit, we do not need to take that distinction into account.

The transaction costs of activity based costing are relatively straightforward. Setting up an activity based costing system is much more time consuming because the organisations needs to perform an activity analysis which requires deep specific knowledge about the production process. I could only do the current exercise because it is about my job. Also, the IT requirements for a realistic system with over a hundred activities and thousands of cost objects are much larger than for a traditional and more simple system [18]. Lastly, updating a complex activity based costing system is much harder. The organisation has to incorporate new activities and new products or customers over time, which is much harder than for a more simple cost accounting system. With a complex activity based costing system, the addition of a new type of customer could mean that all cost allocations of all activities need to be adapted to accommodate every new customer. As a result, if progress in information technological helps firms to manage the complexity and the updates of an activity based costing system, than technology can lead to more firms adopting ABC.

- as in, the car I have, which happens to be a Hyundai Getz ↵

- as in, all Hyundai Getz produced ↵

- For instance, how much of time is dedicated to writing this book ↵

- One way to think about this that an average cost per student can be informative about the actual cost of any given student when the students are fairly similar but not when the students are heterogeneous. ↵

- which is only one part of my job description. ↵

- e.g. AUD 30 per hour. ↵

- An honours year in Australia is a fourth undergraduate year in which students write a research thesis. ↵

- [latex]60 \% \times 15 \%[/latex] ↵

- [latex]40 \% \times 15 \%[/latex] ↵

- [latex]7 / 10 \times 6 \%[/latex] ↵

- [latex]3 / 10 \times 6 \%[/latex] ↵

- [latex]7 \times 15[/latex] ↵

- [latex]24 / (105 + 24) \times 3\%[/latex] ↵

- [latex]105 / (105 + 24) \times 3\%[/latex] ↵

- This assumption is wrong. ↵

- [latex]100 / 115 \times 3\%[/latex] for the undergraduate students and [latex]15 / 115 \times 3\%[/latex] for the honours students ↵

- e.g. scanning technology to track different parts, electronic tracking of employees. ↵

- Just think about the number of footnotes I would need when my example would include every unit at the University of Western Australia ↵