8 Possibilities

POSSIBILITIES and Precarities

In this Chapter:

Introduction to Possibilities and Perils

Business Innovation and entrepreneurship are exciting journeys filled with immense possibilities, but they are also fraught with challenges that can quickly derail even the best ideas. The global statistics are sobering. Around 20% of startups fail within their first year, and nearly 90% don’t make it past the 5-year mark. The good news is that 2% make it with a US$50m exit in 10 years. Reasons for failure include running out of cash, misreading market demand, limited or poor marketing efforts and lacking a clear business model. Despite these challenges, success stories like TradeMe, Amazon, Netflix, and ZURU prove that, with the right strategies, entrepreneurs can thrive in competitive landscapes.

TradeMeTM, New Zealand’s homegrown online marketplace, capitalised on understanding local consumer needs, leading to its dominance in the e-commerce space. Amazon, on the other hand, scaled rapidly by leveraging technology, streamlining logistics, and continually innovating. ZURU, a global toy and consumer products company founded in New Zealand, stands out for its ability to transform simple ideas into market-leading products through bold innovation and relentless execution.

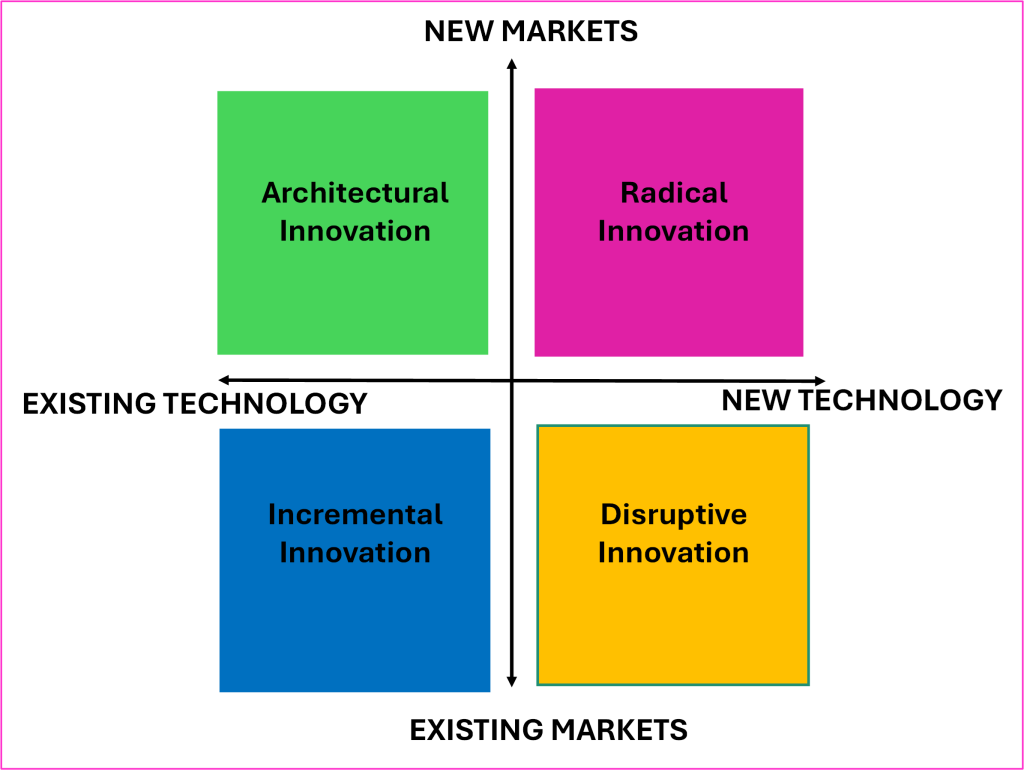

Further, when asking lay-people about innovations in business, they often refer to either product innovations, or radical and disruptive innovations in technology or business models, with AI, Apple, blockchain finance, cancer treatment, Covid-vaccinations, e- and autonomous self-drive vehicles, Netflix entertainment, social media (FB and TikTok) and solar heating/lighting as examples. But innovations can take a whole host of forms. Firstly, innovations can be classified into one of four main categories: architectural, incremental, radical or disruptive. Innovations can then be further categorized into six types: products; services; supply chain; logistics; business models, business processes; and technology. To indicate the shifts in where innovation comes from, The World Economic Forum estimates that 70% of new value created globally over the next 10 years will be based on digital business models. In 2023, for the first time, more than half of GDP was driven by “digitally transformed” enterprises, according to Statista. PWC projects that gains from AI alone will contribute $15.7 trillion to the global economy by 2030.

This chapter explores how entrepreneurs can embrace the dual forces of possibility and precarity to maximise opportunities while mitigating risks. It will equip you with strategies, frameworks, and actionable tools to move from ideation to implementation with confidence.

Disruptive, Radical, Architectural, and Incremental Innovations

Innovation drives progress, but not all innovations are the same. A four-segment matrix model, based on two dimensions: the market it serves, and the technology is uses — delivers four categories: disruptive, incremental, architectural and radical innovations.

Disruptive Innovation occurs when a new product or service reshapes an entire industry, often by appealing to a previously underserved market. For example, TradeMe revolutionised the New Zealand marketplace by creating a user-friendly online platform that displaced traditional classified advertisements. Some authors and executives think of disruptive innovation as reshaping the marketplace by taking some components of a highly developed industry, back to some of the basic key needs that drove the uptake in the first place. After Netflix disrupted the media industry, Blockbuster (the then leader for video rentals in the USA), went from having more than 9,000 Blockbuster brick-and-mortar stores to one. What customers wanted was easy access to their own unique selection of movie and film entertainment, with no interruptions by advertisements, no hassles to collect and return material, and a wide range of options.

Some disruptive innovations transform the market by displacing long-standing, established competitors. Here, disruptive innovation refers to innovations and technologies that make expensive or sophisticated products and services accessible and more affordable to a broader market. Examples include the way in which Amazon launched an online bookstore in 1990, or the Spotify services, where users can buy a single piece of music, not the entire disc or LP, the introduction of digital music downloads, which have, largely replaced compact discs. OpenAi, (generative AI as it’s often called) and its potential to learn from employees and perform jobs effectively and faster, may soon be a disruptive innovation for the job market as a whole.

Radical Innovation introduces ground-breaking ideas that drastically change the market or create entirely new industries. Radical innovations are inventions that destroy or oust existing business models. They blow up existing systems and processes to replace them with something new. Radical innovations find new markets with new technologies and normally come from a new stream of technological advancements, e.g., X-rays, Internet, GenAI, blockchain, and genome sequencing in medicine.

Architectural innovation

Firms innovate by leveraging existing technologies into new markets. Companies here reconfigure the known components in a new way to access new markets – changing the architecture of the product; e.g., Smart watches or FitBits. Canon’s innovations in printers generally reduced copiers and printers in size (Canon desk top printers) so that private individuals could have their own printers on their desks at home.

Incremental Innovation involves smaller, continuous improvements to existing products or processes. Companies steadily improve their existing products, services and incrementally build on their established knowledge base. Other examples are incremental improvements to Samsung’s mobile phones or Gilette’s new features on their razors. Another example is Amazon’s ongoing optimisation of delivery logistics is a prime example, making services like Prime faster and more reliable, or altering payment methods to ensure ease-of-payment with reduced risk of fraud.

To see the notable benefits and for more on these four innovation types, please visit:

What is the benefit of knowing your Category?

Understanding innovation categories is valuable for entrepreneurs because it provides clarity, focus, and actionable insights.

Strategic Focus

Knowing where your innovation fits—incremental, radical, disruptive, or architectural—helps determine the appropriate resources, strategies, and risks involved.

Example: If you are pursuing radical innovation, you may need greater R&D investment, and a longer timeline compared to incremental innovation.

Market Alignment

Categories help to align your innovation with market demands. Disruptive innovations, for example, target under-served or emerging markets, while incremental innovations enhance value for existing customers.

Actionable Insight: Entrepreneurs can fine-tune their value proposition and messaging to resonate with the right audience.

Resource Allocation

Different types of innovation require distinct allocations of talent, technology, and capital.

Example: Incremental innovations might benefit from cross-departmental collaboration, whereas disruptive innovations may need a dedicated team to avoid conflicting priorities.

Risk Management

Categorization reveals potential risks and challenges. Radical innovations often face high market uncertainty, whereas incremental innovations risk being too incremental and irrelevant.

Actionable Insight: Entrepreneurs can craft mitigation strategies tailored to their innovation type.

Competitive Advantage

Understanding categories allows businesses to anticipate competitors’ moves and identify gaps in the market.

Example: If competitors are focused on incremental improvements, a radical or disruptive innovation could leapfrog the market.

How to Use Categorization Effectively

Once entrepreneurs categorize their innovation, they can take targeted actions:

1. Identify Key Priorities

- Incremental Innovation: Focus on enhancing existing products or services.

- Action: Gather customer feedback regularly to prioritize improvements.

- Radical Innovation: Invest heavily in R&D and collaborate with industry experts.

- Action: Explore partnerships with universities, labs, or think tanks.

- Disruptive Innovation: Target under-served markets and deliver simple, affordable solutions.

- Action: Use lean start-up methodologies to test your ideas.

- Architectural Innovation: Reimagine how components of your offering work together.

- Action: Analyse customer workflows and pain points for opportunities to reconfigure solutions.

2. Adjust Resource Allocation

- High-risk innovation (radical, disruptive) requires more time, funding, and market validation efforts.

- Low-risk innovation (incremental) benefits from efficient, iterative processes to maintain momentum.

3. Develop a Go-To-Market Strategy

- Disruptive: Focus on gaining early adopters and word-of-mouth buzz.

- Incremental: Highlight small but meaningful improvements to existing customers.

- Radical: Educate the market and establish thought leadership, celebrity endorsements and approaching gadget/gizmo fans (early adopters) to create demand.

- Architectural: Showcase how reimagined solutions simplify or enhance user experiences.

4. Track Success Metrics

Each category calls for tailored KPIs:

- Incremental: Customer retention, satisfaction scores

- Radical: Adoption rates, market creation metrics

- Disruptive: Cost reduction, customer acquisition in underserved segments

- Architectural: Usage rates of new configurations

5. Revisit and Iterate

Innovation is a dynamic process. Regularly reassess where your innovation fits as market and technology landscapes evolve.

Why Startups Succeed or Fail: Not all Start-ups are Equal

In most cases businesses (both new and old) fail because of a complex combination of reasons. For example, a startup owner fails to draw up a comprehensive business plan or build a business model that seems sustainable over the long run. In that case, the startup might lose money, encounter operational issues, and run into legal problems. Startups also encounter issues with product-market fit. In high-performance startups, teams do extensive market research and incorporate effective marketing strategies while adhering to vision-based, results-driven marketing budgets. Understanding why businesses succeed or fail is key to navigating the precarious nature of innovation and entrepreneurship, and there is unfortunately no easy, single correct recipe for success.

Key Factors Behind Success

Strong Market Fit: Companies like Amazon succeed by identifying and meeting clear customer needs.

Scalability: Businesses that scale effectively, like ZURU, leverage processes and automation to grow rapidly.

Adaptability: TradeMe adapted to shifting consumer behaviours by continually upgrading its platform, whereas several firms (even big guns like Kodak) are conspicuously absent from top brand lists, due to their inability to monitor trend and pivot or adapt their products, services or business models.

Common Causes of Failure

Poor “product-market fit” is still the number one reason why business fails. In other words, a startup was unable to satisfy a real market need with its product. Famed investor Marc Andreessen says that product-market fit is so important, that the lifespan of a start-up can be broken up into two parts: before product-market fit, and after the fit is achieved. According to CBInsights and VStats, 42% of startups fail because they do not solve a real market need. Once it is obtained, it’s a game-changer that increases the chance of success tremendously. Additional marketing problems that add to product incongruency is lack of clear. Further, differentiation in a hyper-competitive marketspace can be an issue. Failing to stand out in competitive markets can doom a business.

Poor Financial Management: Running out of cash remains a top reason for startup failure, following closely on the heels of poor market-fit. The two other major reasons why startups fail include running out of cash (29%).

Ineffective Leadership: Employing the wrong talent, weak decision-making or ineffective team dynamics can undermine even the best innovations or ideas. Not having the right team contributes to 23% of startup failures.

In business, as in war, forewarned is forearmed. Therefore we focus on how entrepreneurs can focus on market intelligence and seek opportunities and threats – overcoming or managing precarities and optimize opportunities.

By combining a proactive approach to possibilities with a structured method for managing precarities, entrepreneurs can innovate with confidence and resilience. As the stories of TradeMe, Amazon, and ZURU show, those who embrace both opportunity and risk are best positioned to thrive in competitive markets.

Exploring Possibilities and Managing Precarities

Innovation is a driving force for business growth, but it comes with inherent risks. Entrepreneurs who balance ambition with pragmatism can unlock transformative possibilities while navigating the precarities that often accompany innovation.

At its core, innovation fuels progress. It allows businesses to differentiate themselves, expand into new markets, and solve problems in ways that resonate with customers. Companies like ZURU, with its groundbreaking products, and Amazon with innovative processes and supply chain developments demonstrate that consistent innovation can lead to industry leadership.

To drive growth through innovation:

Focus on Value: Ask how your idea or solution improves life for your customers.

Leverage Technology: Tools such as AI, blockchain, or IoT can create efficiencies and open new opportunities.

Adopt a Customer-Centric Mindset: Start by solving real-world problems to ensure your innovation meets market demands.

Recognising Emerging Trends and Unmet Needs: The most successful businesses are those that spot trends early and act decisively. Recognising unmet customer needs is a vital part of staying ahead.

How to Identify Trends:

Listen to Customers: Use surveys, social media, and reviews to uncover gaps in the market.

Monitor Industry Reports: Keep an eye on publications like CBInsights, McKinsey, and Mintel Trends to track emerging trends.

Look for Pain Points: Every frustration is an opportunity for innovation.

Example: TradeMe’s success stemmed from understanding that Kiwis wanted a simple, secure, and local online marketplace.

Practical Tip: Use tools like Google Trends or keyword analysis to identify what your target audience is actively searching for.

Unlock Transformative Ideas

Creativity is the heart of innovation. It’s not about wild, abstract concepts but about connecting dots others might miss. Creativity drives solutions that disrupt industries or make existing processes more efficient.

Encourage Diverse Perspectives: Diverse teams bring fresh ideas.

Create a Safe Space for Ideas: Allow brainstorming without fear of judgment.

Experiment and Prototype: Test ideas quickly and learn from feedback.

Example: ZURU took a simple idea—water balloons—and completely reimagined it with its Bunch O Balloons product, revolutionizing a traditional toy market.

Managing Precarities

With innovation comes uncertainty. Markets shift, technologies evolve, and customer preferences change. Successful entrepreneurs anticipate and mitigate these challenges to manage risk effectively.

Uncertainty can be intimidating, but it’s also a natural part of entrepreneurship. Recognising potential challenges early enables you to prepare and adapt.

Types of Business Uncertainties:

- Market Shifts: Demand can fluctuate due to economic changes or competitor activity.

- Technological Disruption: Innovations can make existing products or services obsolete.

- Operational Challenges: Resource shortages or unexpected costs can derail progress.

Practical Tip: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) quarterly (if not more regularly in fast-moving consumer goods (FMCG) and fad-driven, environment-sensitive products and services (such as fashion or tourism) to identify and address uncertainties. Spend time and other limited resources on regularly completed PESTEL analyses with large groups of staff (as your recon soldiers) to understand shifts in the Political, Economic, Social, Technological, Ecological and Legal spheres of the marketspace to identify and react to possibilities (opportunities) and precarities (hurdles and threats) at the earliest possible time.

Risk Management Essentials

Proactive risk management is a critical skill for navigating precarities. The goal isn’t to eliminate risk but to manage it effectively.

Key Steps in Risk Management:

- Identify Risks: Brainstorm potential risks across operations, market, and finance. (See the Risk Management worksheets in 8P of the Toolshed)

- Assess Impact: Prioritize risks by evaluating their likelihood and potential harm.

- Develop Contingency Plans: Prepare “what-if” strategies to act quickly if risks materialise.

- Monitor Regularly: Track risks and adjust strategies as circumstances change.

Example: Amazon mitigated risk in its expansion by piloting services in smaller markets before rolling them out globally, ensuring scalability.

Learning from Failures and Recoveries

Failure is inevitable in business, but it doesn’t have to be final. Companies that view failure as a learning opportunity often emerge stronger.

Case Study:

When ZURU first began, it faced challenges scaling its production and distribution. By analysing the failures, refining its processes, and embracing automation, the company grew into a global powerhouse.

Lessons for Entrepreneurs:

- Analyse Failures: Identify what went wrong without blame.

- Adapt Quickly: Use lessons learned to pivot or improve strategies.

- Communicate Transparently: Keep your team aligned and motivated through challenges.

Here are ten additional examples of ideas that were either not fit for the market or too early for their time:

1. Ice Cream for Dogs

Why it struggled: While niche pet products are more common today, early iterations of this idea faced scepticism from consumers who didn’t view pets as needing such luxuries. The market for premium pet goods had not yet matured.

Lesson: Timing and cultural attitudes (towards pets as family members) matter.

2. Google Glass Smartglasses

Why it struggled: Despite being a technological marvel, Google Glass was released before consumers were ready to embrace wearable augmented reality. Concerns about privacy and the lack of compelling use cases hindered its adoption. Simply being of use to marketers is not a compelling reason for consumers to purchase them.

Lesson: Cutting-edge technology must solve clear, immediate problems for users.

3. The Apple Newton

Why it struggled: Launched in 1993, this early PDA failed due to high costs, technical limitations (notably poor handwriting recognition), and a lack of readiness for mobile computing.

Lesson: Advanced ideas need supportive ecosystems, such as the internet and mobile networks, which were not widely available at the time.

4. WebVan

Why it struggled: This online grocery delivery service launched in 1999 but went bankrupt in 2001. It overexpanded before the market was ready for widespread e-commerce and faced logistical challenges.

Lesson: Being too far ahead of infrastructure and consumer habits can be as risky as having a bad idea.

5. Betamax

Why it struggled: Sony’s Betamax video cassette format was technologically superior to its closest competitor VHS, but it lost the format war due to its shorter recording times and higher costs.

Lesson: Market dominance often hinges on convenience and affordability over technical superiority. See the competitive activities between VHS and Beta here: https://youtu.be/WsaDl7K6Kq4

6. The Segway

Why it struggled: Marketed as a revolutionary personal transport device, the Segway never achieved mass adoption due to high costs, lack of practical applications, and limited regulatory acceptance in cities.

Lesson: Innovations need a clear audience and practical use cases to thrive.

7. Microsoft Zune

Why it struggled: Released as a competitor to Apple’s iPod, the Zune failed due to a late entry into the market, lack of differentiation, and insufficient marketing.

Lesson: Entering an established market requires a unique value proposition to unseat incumbents.

See the unboxing here at : https://youtu.be/2QOOzxbq9qc

or the insights into some of its life-death decisions. https://youtu.be/iSGBH8ptnas

8. Juicero

Why it struggled: These $400 (cold press ) juicers gained notoriety when consumers discovered they could squeeze the proprietary juice packets by hand without needing the machine. It was seen as over-engineered and unnecessary.

) juicers gained notoriety when consumers discovered they could squeeze the proprietary juice packets by hand without needing the machine. It was seen as over-engineered and unnecessary.

Lesson: Products must provide clear value beyond their alternatives.

Start-up Forensics: See Video here: https://youtu.be/mlfAHrpm3C8

9. 3D TVs

Why it struggled: Despite being heavily marketed, 3D TVs failed to catch on because they required special glasses, offered limited content, and didn’t significantly improve the viewing experience for most consumers.

Lesson: Enhancements must deliver a noticeable and valued improvement to justify adoption.

10. Crystal Pepsi

Why  it struggled: This clear cola from Pepsi was marketed as pure and clean, but consumers were confused by its appearance and underwhelmed by the taste.

it struggled: This clear cola from Pepsi was marketed as pure and clean, but consumers were confused by its appearance and underwhelmed by the taste.

Lesson: Novelty alone cannot sustain a product without delivering on core expectations.

See the case here at: Why Did Crystal Pepsi Fail? | CulinaryLore

These examples highlight the importance of market timing, customer readiness, and delivering clear, practical value. Entrepreneurs can learn from these failures to ensure their innovations are both relevant and viable.

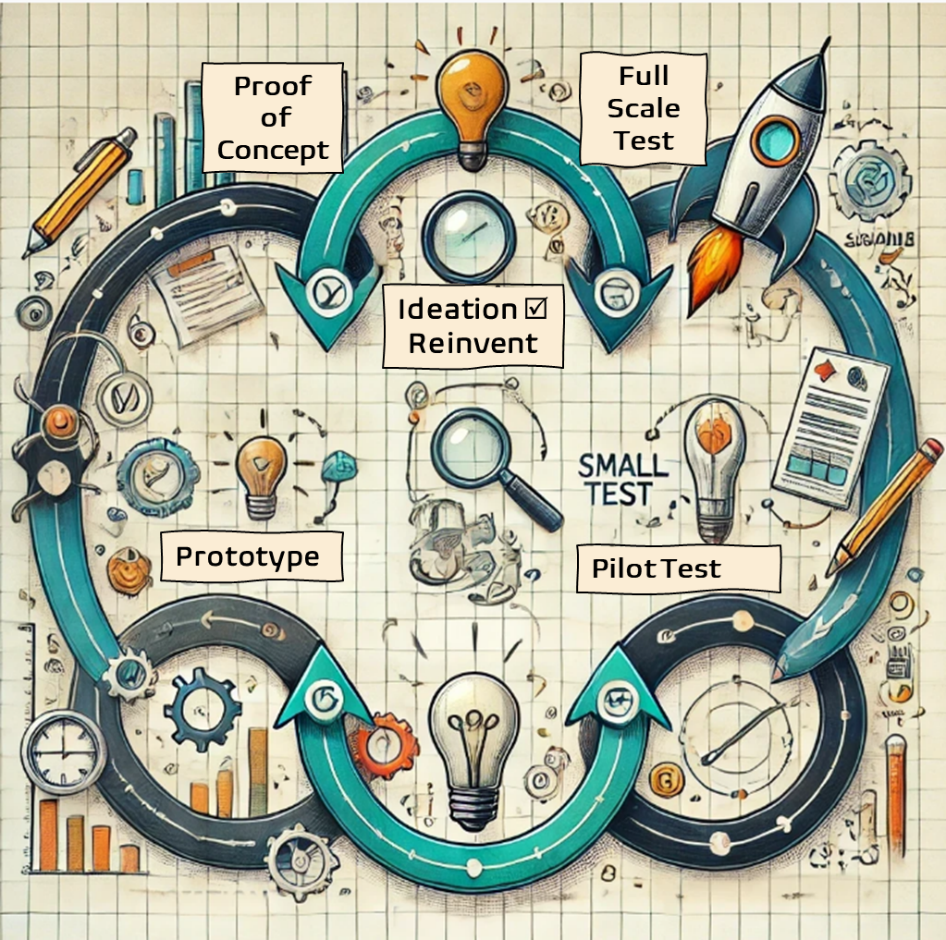

Concept Testing, Prototyping, Piloting & Precipitating: Bringing Ideas to Market

Many practitioners and scholars (often in collaboration) have designed tools, models and frameworks to help creative genii to identify which of their cache of great ideas and inventions they should pursue, which to cull and which to re-develop or adapt for market adoption. (This book does not have the scope to cover Technology adoption models (TAM) and customer adoption theories here, but ambitious marketers and product developers will do well to study those theories and models – and refer back to Persuasion – to help with their idea selection processes.

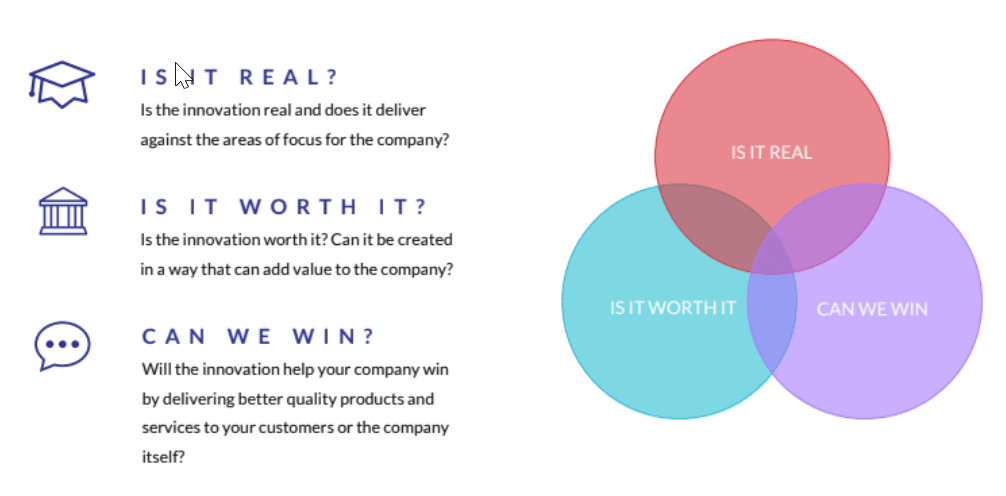

RWW (Real-Win-Worth) Analysis

The RWW framework is a strategic tool to evaluate innovation opportunities. It asks three key questions:

Is it Real?

- Does the market need exist, and can it be met with available technology?

Can We Win?

- Do you have the resources, capabilities, and market positioning to succeed?

Is it Worth it?

- Does it provide sufficient return on investment to justify the effort?

The Essence of RWW: Real, Win, Worth

The RWW framework simplifies the complex journey of innovation by breaking it down into three core questions: Is it Real? Can We Win? Is it Worth it? These seemingly straightforward questions push companies to critically examine their innovation strategies, avoiding pitfalls and ensuring alignment with broader business goals.

Each dimension of RWW probes essential aspects of a product or idea:

- Is there a genuine, tangible market for the product?

- Can the product move beyond concept to become a feasible, functional reality?

- Will the product hold its ground in a competitive landscape?

- Does the company possess the resources and capabilities to outpace competitors?

- Will the product generate profit without exposing the business to undue risk?

- Most importantly, does it align with the company’s overarching strategic vision?

At first glance, these questions may appear simplistic, but their power lies in their clarity. They force businesses to move past vague “maybes” and confront the realities of their innovation efforts. By demanding decisive answers, the RWW framework helps businesses avoid costly missteps in a volatile and competitive market environment.

The Market Reality

One of the most pivotal aspects of RWW is its emphasis on market reality—the foundation upon which all successful innovations rest. Without a genuine market need, even the most ground-breaking ideas can fail. Consider products like the Segway personal transporter and Motorola’s Iridium satellite phone. Both were marvels of engineering but ultimately missed the mark. They failed to identify and address a clear, widespread demand, leading to poor adoption and financial losses.

For a market to be deemed “real,” it must meet four critical criteria:

- Solve a Genuine Need: The product must address a real problem or desire.

- Be Superior to Competitors: It should offer clear advantages over existing solutions.

- Be Accessible: Price and distribution must make the product reachable for its target audience.

- Have Sufficient Demand: The market size should justify the investment.

Example: When Spotify entered the music streaming market, it identified an unmet need for affordable, on-demand music access while offering clear advantages over piracy and downloads. Its combination of accessibility, price, and a growing audience ensured its market reality.

Practical Tip: Conduct thorough market research and validate assumptions with surveys, focus groups, or pilot programs to avoid overestimating demand.

The Competitive Landscape

The “Win” dimension of RWW evaluates whether a company can outperform competitors in a challenging business environment. In today’s hyper-competitive world, even groundbreaking ideas must be supported by a strong, sustainable competitive edge.

Tips for Conducting Marketing Research

(From Forbes, How to Start a Business (2025 Guide) – Forbes Advisor)

Arguably the most effective way to start your pre-launch research is by talking to someone with experience in your chosen field and knowledge of your vicinity (for local businesses). The Small Business Administration (SBA) recommends studying six aspects of your market:

- What’s the level of demand for your product or service now and in the future?

- Who constitutes the market for your business? Devise profiles of your target customers and determine what will attract them to your product or service.

- What is the state of the economy in your target market? This will impact both consumer demand and your planned/strategic marketing approach.

- Where are your customers located, and how will they reach your business? This includes e-businesses and the online component of brick-and-mortar operations that need a digital marketing strategy.

- What’s the level of market saturation for your business, and what similar options are available to your target customers?

- How much will people be willing to pay for your product or service, and will your business be able to realize a profit at this price point?

A product’s competitive advantage is its shield against market volatility. Patents, exclusive technologies, unique value propositions, and niche expertise can all contribute to a defensible position. However, success isn’t solely about the product—it also depends on the company’s strengths, such as agility, market insights, and operational excellence.

Example: In the recent past (now being overtaken by other suppliers) Tesla’s dominance in the EV market wasn’t just about its vehicles but also about its ability to leverage vertical integration (like owning battery production) and build a strong brand identity. These factors create a moat that competitors struggled to cross.

Practical Tip: Regularly benchmark your innovation against competitors, analysing their strengths and weaknesses to uncover opportunities to differentiate.

Evaluating Worthiness

The final pillar of RWW, “Worth,” challenges businesses to consider whether a product aligns with their broader objectives. This step transcends financial viability, focusing on strategic alignment.

- Does the product reinforce the company’s brand values and long-term vision?

- Can it open new growth opportunities or unlock untapped markets?

- Will it provide a meaningful return on investment within an acceptable risk threshold?

Example: Apple’s decision to develop the Apple Watch aligned with its strategy of deepening its ecosystem. The product reinforced Apple’s focus on lifestyle innovation, opened new revenue streams, and expanded its reach into health and fitness markets.

Practical Tip: Use scenario planning to test how the product fits within the company’s long-term growth strategy and risk tolerance.

More than a mere tool, the RWW framework is a mindset that fosters clarity, focus, and purpose. It encourages companies to (i) introspect deeply, challenging assumptions about markets, competition, and capabilities; (ii) adapt quickly, leveraging insights to pivot strategies where needed; and (iii) align strategically, ensuring that every innovation contributes to the company’s larger goals. In a world where market dynamics shift rapidly and consumer expectations evolve constantly, RWW provides a structured approach to innovation that reduces uncertainty and sharpens decision-making.

Example: ZURU used RWW principles to evaluate the potential of new product lines, ensuring alignment with customer needs and internal capabilities.

Pro-Tip: Regularly revisit the RWW questions during the innovation process to stay aligned with your goals and market realities.

Financial Forecasts: Preparing for Success

Financial forecasting provides a roadmap to understand the economic implications of your innovation. It helps in setting budgets, attracting investors, and managing cash flow.

Key Elements of Financial Forecasting:

- Revenue Projections: Estimate income based on market size, pricing, and sales channels.

- Cost Analysis: Include production, marketing, and operational costs.

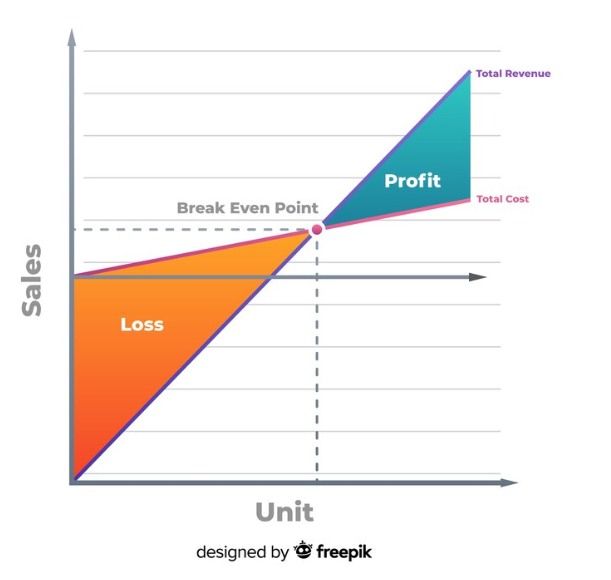

- Break-Even Analysis: Identify the point at which revenue covers expenses.

- Sensitivity Analysis: Model best- and worst-case scenarios to plan for uncertainty.

Example: TradeMe used financial forecasting to ensure a steady revenue model from listing fees and premium features while scaling its platform.

Practical Tip: Use tools like Microsoft Excel, QuickBooks, or specialized forecasting software to build accurate financial models.

Build Financial Forecast

What are your estimated costs and revenues for the first year?

When will your business break even?

A key realization for adept entrepreneurs is that constant evaluation at every stage of the innovation process enables resources to be deployed in the project/launch team in a targeted manner – focusing limited resources and innovation activities on the most promising ideas.

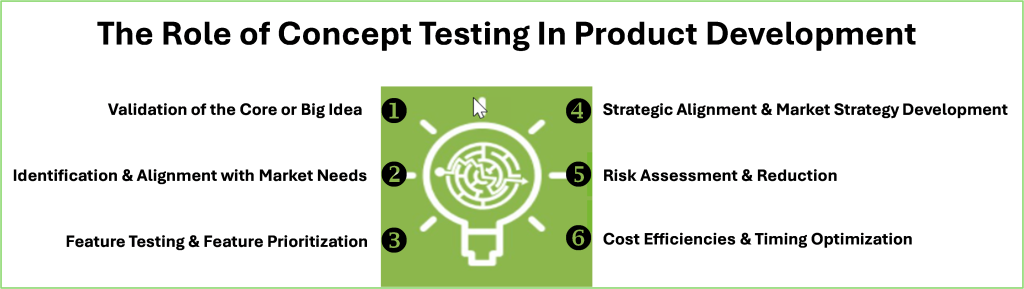

Concept Testing and Proof of Concept (POC): A Quick Overview

A Proof of Concept (POC) is a focused, small-scale project that validates whether an idea, method, or technology is feasible. It helps entrepreneurs and innovators:

Validate that a concept can be practically implemented.

Explore potential challenges early.

Demonstrate viability to stakeholders or investors.

Gather critical feedback for refinement.

POCs focus on core functionality rather than a full product and are often used in tech and product development to minimise risks.

When to Use a POC

- Validation: Ensures a marketable product meets customer needs.

- Investor Pitch: Demonstrates a sound, financially viable concept.

- Staff Buy-in and capability allocation.

- Problem Resolution: Identifies challenges before scaling.

Benefits of a POC

- Knowledge: Even failed POCs reveal useful insights.

- Team Alignment: Ensures shared understanding among stakeholders.

- Risk Reduction: Prevents investment in unviable solutions.

- Message Refinement: Ensure name, logo, brand and marketing communications are clear and well aligned with the brand and brand positioning.

Proof of Concept (POC) vs Proof of Technology (POT)

POC: Focuses on whether the solution solves a specific problem.

POT: Tests whether the technology itself can support the project’s goals.

Both approaches provide clarity on technical and solution feasibility, enabling informed decisions before full-scale development.

Types of Proof of Concept

1. Purchase intent testing

Purchase intent testing reveals whether customers are ready to buy your product. It starts by gauging interest in the product itself, then assesses willingness to pay your price and the likelihood of repeat purchases, offering a complete view of potential demand.

2. Product development concept testing

Launching a product without testing is risky, as ideas that seem great internally can fail in the real-world, real-life application of the market. Concept testing ensures alignment with customer expectations by evaluating design, features, and usability and fit-with-lifestyle before production. E.g., failures like Crystal Pepsi highlight the importance of testing to avoid costly misjudgements.

3. Advertising and campaign testing

Creatives and ad agencies get really excited about their BIG IDEAS. However, creating campaigns in isolation risks missing how they resonate with the targeted audiences. Testing ads and creative elements like landing pages or social posts ensures your message connects effectively. By gathering consumer feedback before launch, you can refine ideas, understand perceptions, and avoid common blind spots. For example, Pepsi’s 2017 ad featuring Kendall Jenner, aimed at promoting unity, sparked backlash for its tone. Proper testing with diverse consumer groups could have flagged these issues early, preventing a brand reputation crisis.

Read more about the Pepsi 2017 Advert here:

Pepsi Pulls Controversial Kendall Jenner Ad After Outcry .

See the Video here: https://youtu.be/aqQG4cGl2dI or here : https://youtu.be/D_Bj_dSlQKM

4. Logo testing

Your logo is the face of your brand, representing your values and identity. Logo testing ensures your design resonates with your target audience by evaluating its appeal, impact, and adaptability across platforms. This step helps you create a memorable, standout logo that aligns with your brand’s vision and helps with the 6Rs and 1G. Airbnb tested its logo in 2014. It aimed to represent belonging and unity but faced social media comparisons to Automation Anywhere’s design. Despite the backlash, Airbnb kept the bold and memorable logo, showing the importance of testing to ensure a design communicates the right message and avoids controversy and making informed decisions.

5. Name testing

A name shapes a brand’s identity, perception, and emotional resonance, making early-stage name testing essential. Examples like Tinder (originally “Matchbox”) and Google (once “BackRub”) highlight how testing ensures a name is memorable, distinct, and aligned with the brand’s vision. By refining names early, businesses can avoid confusion and create lasting impressions.

Pro Suggestions about the Process:

- Use research data (and refer back to early DT empathy sheets) to understand what you want to concept test.

- Brainstorm a solution and the scope of the POC.

- Decide on the technology used in the process; scope of POT.

- Demonstrate product functionality and identify possible features.

- Present POC, using the selected POT and get feedback.

Turning an idea into a successful innovation requires more than creativity: it demands a structured approach to ensure that the concept is viable, desirable, and feasible. Prototyping, testing, feasibility studies, and tools like RWW (Real-Win-Worth) analysis, combined with robust financial forecasting, help entrepreneurs navigate this critical phase with confidence.

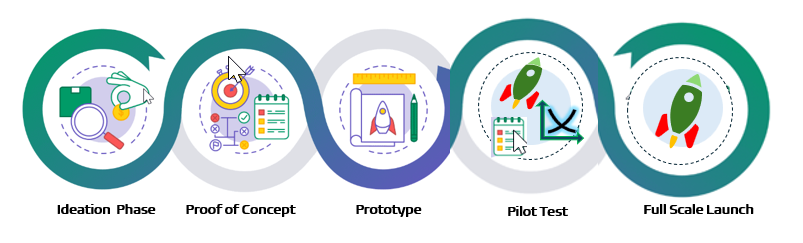

Prototyping: From Concept to Reality

Prototyping is the process of creating a preliminary version of a product or service to test its functionality, design, and user appeal. This step allows entrepreneurs to visualise their ideas and identify potential flaws early.

Key Benefits of Prototyping:

- Visualisation: Converts abstract ideas into tangible solutions. This may include mood boards, somewhat realistic drawings, foam models and first-draft concept prototypes. (See proof of concept in the next section).

- Risk Reduction: Highlights design flaws or functional gaps before full-scale production.

- User Feedback: Provides real-world insights into usability and customer satisfaction. Use customer focus groups or niche piloting to get feedback from various niche clients (e.g., new palm-size printers might be tested with large firms, schools, consultants and home-based employees).

- Example: ZURU used rapid prototyping to test early designs of its innovative toys, allowing it to refine features before mass production.

- Practical Tip: Use low-cost methods like 3D printing or digital mock-ups for initial prototypes to minimise expenses.

Testing: Validating Assumptions

Testing ensures that the prototype meets customer needs and market expectations. It involves gathering data, refining the design, and ensuring scalability.

Steps in Testing:

- Define Metrics: Decide what success looks like (e.g., user satisfaction, durability, or efficiency).

- Conduct A/B Testing: Compare different versions to determine which performs better.

- Gather Feedback: Use focus groups, surveys, or pilot programs to collect user input.

- Review & Redesign: Use the evidence-based input to change the prototype to include the desired components or to the customers’ expected/augmented product and services.

Example: Amazon rigorously tests new features on small customer segments before a global rollout, ensuring minimal disruption and maximum impact.

Practical Tip: Focus on small, iterative tests to improve the product step by step rather than attempting large-scale testing at the outset.

Feasibility Studies: Assessing Viability

A feasibility study evaluates whether an idea is practical and worth pursuing. It considers market demand, technical challenges, operational requirements, and financial implications.

Key Components of a Feasibility Study:

- Market Analysis: Is there demand for this product or service?

- Technical Feasibility: Can it be built with current technology and resources?

- Operational Viability: Can the team execute it effectively?

- Financial Feasibility: Is it economically viable?

Example: Before launching its Prime service, Amazon conducted feasibility studies to assess logistics, pricing, and customer value.

Practical Tip: Document your findings to present to stakeholders and investors, showcasing data-driven decision-making.

Read more on proof of concept and prototyping here:

Proof of Concept vs Prototype vs MVP: How to Choose the Right Approach for Your Product

Pilot Testing

After the initial concept testing and limited viability testing, the innovation is ready for launching into a small, focused segment of the market (the segmentation could be demographic, geographic, psychographic or possibly behaviour towards the product). This is called pilot testing the innovation. A pilot run, is a small-scale test or trial of a new process, system, or change in a controlled environment before implementing it on a larger scale.

The Pilot test stage is to learn fast and improve fast – to find pain-points and success points in order to improve, change tactics, changes key parts of the marketing campaigns (product, price, promotion, place, partners, processes, payment methods, physical evidence) to re-launch into other larger market segments or even totally different market segments, perhaps even different distribution options (e.g. online vs retail).

Pilot runs are a vital step in uncovering design flaws and addressing challenges that may have been overlooked during prototyping. By using production methods that mirror mass manufacturing, businesses can identify quality issues and refine processes before committing to large-scale production.

Beyond production, pilot tests and pilot runs simulate market conditions, offering insights into how a product performs in real-world scenarios. This phase allows entrepreneurs to fine-tune features, functionalities, and overall performance to ensure a smoother path to full launch.

How to run a successful pilot test:

How to Execute a Successful Pilot Test

A successful pilot test demands thorough planning, cross-functional collaboration, and clear objectives. It’s not a last-minute task but a critical phase to ensure smooth scaling to mass production.

1. Foster Cross-Functional Collaboration

Ensure seamless coordination among key teams, including procurement, engineering, production, quality, and product management. Collaboration is essential both for preparation and for resolving issues swiftly during the pilot, preventing costly delays in mass production.

Pro Tip: Schedule regular meetings between various teams (across functions and even firms) to anticipate challenges and streamline communication.

2. Define Clear Objectives

Set specific goals and metrics to evaluate the pilot’s success. These could include: (i) Defect rate; (ii) production efficiency; (iii) bottleneck identification and (iv) Resource allocation.

Practical Tip: Define success criteria for the pilot run, such as achieving a minimum defect rate or optimal production speed, to guide decisions on scaling.

3. Determine the Optimal Sample Size

The pilot run should balance being statistically significant with resource efficiency. A typical size ranges from 10% to 20% of the total purchase order, depending on the initial order’s scale.

Pro Tip: Start small but meaningful—adjust the sample size as insights emerge.

4. Collect and Analyse Data

Capture and analyse data throughout the pilot run to identify trends, address weaknesses, and confirm readiness for mass production. Without this step, evaluating the pilot’s success becomes guesswork.

Practical Tip: Use tools like dashboards or production tracking software with various to visualised metrics to streamline analyses and insights.

By following these steps, entrepreneurs and manufacturers can confidently transition from the pilot phase to mass production, reducing risks and optimizing performance.

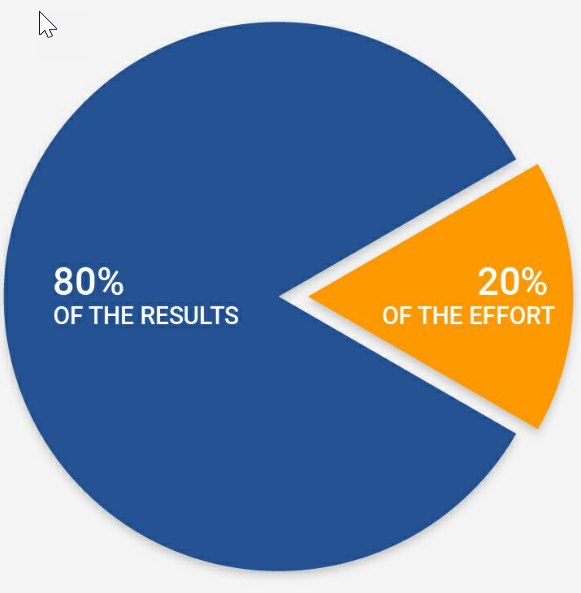

You will read about agile models and other strategies to ensure that iterative design and pilot processes for pilot testing and making a first model (80% near perfect – Pareto Principle; see Figure 8.13) for a test market, then iterating and changing benefits/features/components that customers value.

5. Precipitation Scaling and Optimisation

Once a pilot is successful, focus shifts to scaling the innovation for broader audiences or markets. This phase includes refining operations, enhancing processes, and optimizing resource allocation to ensure efficiency at scale. Scaling also involves monitoring performance metrics to maintain quality while adapting to the demands of larger markets.

Key Considerations:

Infrastructure Readiness: Ensure production, distribution, and support systems can handle increased demand.

Consistency: Maintain the quality and experience that made the pilot successful while expanding.

Feedback Loops: Continue gathering user insights to refine and improve at scale.

Example: Spotify scaled from a pilot in Sweden to a global market by improving infrastructure and licensing agreements while maintaining its core user experience.

6. Continuous Innovation and Reinvention

Innovation is an ongoing process, and the final phase focuses on sustaining relevance in a dynamic market. Continuous improvement ensures that the product evolves alongside customer needs, emerging technologies, and competitive pressures. Reinvention may involve launching updated versions, expanding features, or exploring adjacent opportunities.

Key Considerations:

Adapt to Trends: Monitor market shifts and emerging technologies to stay ahead.

Stay Customer-Centric: Regularly engage with users to understand their evolving expectations.

Explore Adjacent Markets: Use your existing strengths to expand into related areas.

Example: Matchbox Cars continually refreshes its offerings by adding limited-edition collectibles, tapping into nostalgia, and exploring licensing opportunities with popular media franchises.

As a summary of the section on Going to Market, this iterative (almost infinite) framework of ideate, design, test and reinvent ensures that businesses not only launch successfully but also thrive and sustain their competitive edge over time.

60-second Executive Summary (60 ES) of Chapter 8 – POSSIBILITIES-focus

Innovation thrives at the intersection of opportunity and risk. Various validation, feasibility and customer adoption testing methods such as concept validation, prototyping, and purchase intent analysis help refine innovations before major investments.

Exploring possibilities means identifying genuine market needs, leveraging emerging trends, and using frameworks like the RWW (Real-Win-Worth) analysis to evaluate ideas. Successful innovations, whether incremental or disruptive, align with customer expectations and the company’s strategic vision. Tools such concept testing, prototyping, and purchase intent testing ensure ideas resonate with real audiences before major investments are made.

Managing precarities requires recognising potential risks and uncertainties early. Feasibility studies, pilot tests, and financial forecasting provide critical insights, allowing entrepreneurs to refine their strategies and minimise exposure to failure. Collaboration between cross-functional teams and the use of clear metrics ensures these tests provide actionable insights for scaling. A real-world example such as Spotify’s market-focused rollout highlights how preparation transforms risk into manageable challenges.

The chapter underscores the importance of testing at every stage—from naming and logo design to full-scale product launches. Lessons from failures like Crystal Pepsi and the Pepsi ad controversy demonstrate the cost of skipping these steps, while successes like Airbnb’s logo and Slack’s targeted pilots show how thorough testing strengthens outcomes. By embracing structured approaches to innovation and risk management, entrepreneurs can unlock opportunities while navigating the precarities of today’s dynamic business landscape. The key takeaway: innovation thrives when guided by data, collaboration, and adaptability.

References

Amato, Natalli (December 05, 2024). AI news at Amazon: Generative AI for recapping TV shows, a new lineup of Fire HD tablets, and more. Retrieved January 28, 2025 from https://www.aboutamazon.com/news/innovation-at-amazon

Amazon. (n.d.). Amazon Leadership Principles. Retrieved January 28, 2025 from https://www.aboutamazon.com/about-us/leadership-principles

Belyh, A. (February 14, 2023). The Ultimate List of Startup Statistics for 2025. Founderjar. https://www.founderjar.com/startup-statistics/

CBInsights. (August 3, 2021). The top 12 reasons startups fail. https://www.cbinsights.com/research/report/startup-failure-reasons-top/

Christensen Institute (n.d.) Disruptive Innovation Theory. Retrieved January 28, 2025, from https://www.christenseninstitute.org/theory/disruptive-innovation/

Cooper, R. G. (1990). Stage-gate systems: A new tool for managing new products. Business Horizons. 33(3) 44-54 https://doi.org/10.1016/0007-6813(90)90040-I

Hargrave, M. (February 21, 2024). Financial forecasting: Definition, 7 methods + how to do it. QuickBooks. https://quickbooks.intuit.com/r/running-a-business/financial-forecasting/

Howarth, J. (November 4, 2024). Startup Failure Rate Statistics. Exploding Topics. https://explodingtopics.com/blog/startup-failure-stats

McGrath, M. E., & Akiyama, H. (1996). RWW: A practical framework for innovation. Research Technology Management.

Shopify. (n.d.). Shopify story: The first Shopify store was our own. Retrieved January 28, 2025 from https://www.shopify.com/about

Startup Genome. (n.d.). The Global Startup Ecosystem Report 2022: The State of the Global Startup Economy Retrieved February 13, 2025 from https://www.startupgenome.com/article/the-state-of-the-global-startup-economy

Team Asana. (January 10, 2025). What is Proof of Concept. Asana. https://asana.com/resources/proof-of-concept

TradeMe. (n.d.). About Us: Our Story. Retrieved January 28, 2025, from https://www.trademe.co.nz/c/community/article/our-story

Watson, M. (October 14, 2024). Prototype Examples from Top Tech Companies. Full Scale. https://fullscale.io/blog/prototype-examples-from-top-tech-companies

ZURU. (n.d.). About. Retrieved January 28, 2025 https://zurutoys.com/about