Topic 4: Bond valuation

In this topic, you will learn different concepts on bonds. A bond is a debt security. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time.

When you buy a bond, you are lending to the bond issuer. The issuer may be a government, municipality, or corporation. In return, the bond issuer promises to pay you a specified rate of interest during the life of the bond and to repay the principal. The interest payment is known as the coupon and the principal is known as the face value or par value of the bond.

Bond markets are primarily over-the-counter transactions with dealers connected electronically. There are extremely large number of bond issues, but generally low daily volume in single issues. Therefore, it makes getting up-to-date prices of the bonds difficult, particularly for a small company. However, government securities are an exception. The reported volume of bonds traded is not indicative of total activity in the bond market due to off-exchange transactions.

In this topic, you will learn the following concepts:

Concept 1: Articulate characteristics and types of bonds.

Concept 2: Bond valuation.

Concept 3: Relation between interest rate and bond value

Concept 4: Duration of bonds

Concept 5: Factors that affect bond coupon rate

Concept 1: Articulate characteristics and types of bonds.

Bonds are classified based on:

- Registered or bearer bonds.

- Security on the bond

- It can be collateral—secured by financial securities

- It can be mortgage—secured by real property, normally land or buildings

- It can be notes—unsecured debt

- Seniority

- Secured bonds: Secured debt is less risky because the income from the security is used to pay it off first

- Unsecured bonds

Potential bond issuers would be willing to pay rating agencies tens of thousands of dollars in order to receive a rating. Even though, the possibility is that the resulting rating could be less favourable than expected. This is because there is agency cost and information asymmetry between the bond issuer and buyer. A bond rating can mitigate information asymmetry.

By looking at bond ratings, you can identify if the bond is of investment quality or junk. Investment grade bonds can be high grade and medium grade where the capacity of repayment is strong or very strong.

High grade bonds are Moody’s Aaa and S&P AAA—capacity to pay is extremely strong and Moody’s Aa and S&P AA—capacity to pay is very strong

Medium Grade bonds are Moody’s A and S&P A—capacity to pay is strong, but more susceptible to changes in circumstances and Moody’s Baa and S&P BBB—capacity to pay is adequate, adverse conditions will have more impact on the firm’s ability to pay

Speculative bonds can be low or very low grades. Low-grade bonds are Moody’s Ba and B, S&P BB and B. It is considered possible that the capacity to pay will degenerate.

Very low-grade bonds are Moody’s C (and below) and S&P C (and below) income bonds with no interest being paid, or in default with principal and interest in arrears.

There are other types of bonds:

- Catastrophe bonds: These are issued by property and casualty companies. It pays interest and principal as usual unless claims reach a certain threshold for a single disaster. At that point, bondholders may lose all remaining payments. These types of bonds have higher coupon rate.

- Income bonds: For these bonds coupon payments depend on level of corporate income. If earnings are not enough to cover the interest payment, it is not owed. These types of bonds have higher coupon rate.

- Put bonds: bondholder can force the company to buy the bond back prior to maturity. These types of bonds have lower coupon rate.

Concept 2: Bond valuation

Financial assets such as bonds are valued by discounting the known future cash flows at the market interest rate and adding the resultant present values of the future cash flows.

A coupon is also known as yield. However, yield to maturity is the market return of similar bonds.

Valuing a bill

Suppose you want to borrow $100 000 for 180 days. Currently, 180-day bills are trading in the market at a yield of 4.25%. What amount would you receive today if you issued this bill?

We will use the below formula with a little change since we are valuing a 180 day bill.

| 3.3 | Price of a zero-coupon bond | [latex]P_B=\frac{F_{mt}}{{(1+r/m)}^{mt}}[/latex] |

Daily rate = 0.0425÷365 = 0.00011

Rate for 180 days = 0.00011 * 180 = 0.0209

Price = $100 000 / (1+ 0.0209)

= $97 947.14

Valuing a discount bond with annual coupons

Consider a bond with a coupon rate of 10% with annual coupons. The face value is $1000, and the bond has 5 years to maturity. The yield to maturity is 11%. What is the value of the bond?

| 3.1 | Price of a bond | [latex]P_B=\frac{C}{r}\times\left[1-\frac{1}{\left(1+r\right)^t}\right]+\frac{F_t}{{(1+r)}^t}[/latex] |

Price = PV of annuity + PV of lump sum

Price = 100[1 – 1/(1.11)5] / 0.11 + 1000 / (1.11)5

Price = 369.59 + 593.45 = 963.04

Valuing a premium bond with annual coupons

Suppose you are thinking about buying a bond that has a 10% annual coupon and a face value of $1000. There are 20 years to maturity, and the yield to maturity is 8%. What is the price of this bond?

| 3.1 | Price of a bond | [latex]P_B=\frac{C}{r}\times\left[1-\frac{1}{\left(1+r\right)^t}\right]+\frac{F_t}{{(1+r)}^t}[/latex] |

Price = PV of annuity + PV of lump sum

Price = 100[1 – 1/(1.08)20] / 0.08 +1000 /(1.08)20

Price= 981.81 + 214.55 = 1196.36

Concept 3: Relation between interest rate and bond value

In this section you will understand the relation between bond prices and interest rate. This is in the form of bond pricing theorem.

Bond pricing theorems

Theorem 1: Bond prices are inversely related to interest rate movements. As interest rates decline, prices of bonds rise; as interest rates rise, prices of bonds decline.

Theorem 2: For a given change in interest rates, the prices of long term bonds will change more than short term bonds.

Theorem 3: For a given change in interest rates, the prices of lower coupon bonds change more than the prices for higher coupon bonds.

Further,

If YTM = coupon rate, face value = bond price

If YTM > coupon rate, face value > bond price

- Why? The discount provides yield above coupon rate

- Price below face value, called a discount bond

If YTM < coupon rate, face value < bond price

- Why? Higher coupon rate causes value above face value

- Price above face value, called a premium bond

Notice, that there are the purely mechanical reasons for these results. You know that present values decrease as rates increase. Therefore, if you increase your yield above the coupon, the present value (price) must decrease below face value. On the other hand, if you decrease your yield below the coupon, the present value (price) must increase above face value.

There are also more intuitive ways to explain this relationship. Note that the yield to maturity is the interest rate on newly issued debt of the same risk and that debt would be issued so that the coupon = yield. Then, suppose that the coupon rate is 8% and the yield is 9%. Which bond you would be willing to pay more for? You will probably think that you would pay more for the new bond. Since it is priced to sell at $1000, the 8% bond must sell for less than $1000. The same logic works if the new bond has a yield and coupon less than 8%.

Another way to look at it is that return = ‘dividend yield’ + capital gains yield. The ‘dividend yield’ in this case is just the coupon rate. The capital gains yield has to make up the difference to reach the yield to maturity. Therefore, if the coupon rate is 8% and the YTM is 9%, the capital gains yield must equal approximately 1%. The only way to have a capital gains yield of 1% is if the bond is selling for less than face value. (If price = face value, there is no capital gain.) Technically, it is the current yield, not the coupon rate + capital gains yield, but from an intuitive standpoint, this helps some students remember the relationship and current yields and coupon rates are normally reasonably close.

Interest rate risk

The interest rate risk is the chance that interest rates will change in the future, thereby changing the value of an asset.

Interest rate risk in the context of Bond Valuation

Interest rate risk refers to the risk that the value of a bond will change due to changes in the prevailing interest rates in the economy. In general, when interest rates rise, the value of existing bonds with lower interest rates decreases, since investors can obtain higher returns by investing in new bonds that offer higher interest rates. Conversely, when interest rates fall, the value of existing bonds with higher interest rates increases, since investors will pay a premium to obtain these higher returns.

Interest rate risk is particularly relevant in the context of bond valuation, since the value of a bond is determined by the present value of its future cash flows, which are discounted using an interest rate. As interest rates change, the discount rate used to value the bond will also change, which in turn will affect the bond’s present value. Thus, changes in interest rates can have a significant impact on the value of a bond, and investors must take this risk into account when valuing and investing in bonds.

Risk-free bonds are typically defined as bonds issued by a government with a low default risk, such as the United States Treasury bonds or Research Bank of Australia bonds. While these bonds may be considered relatively safe, they are still subject to certain types of risks.

One type of risk faced by risk-free bonds is interest rate risk. As mentioned earlier, changes in prevailing interest rates can affect the value of a bond. Even though risk-free bonds may be considered to have a lower default risk, the value of these bonds can still be impacted by changes in interest rates.

Another type of risk is inflation risk. Inflation risk refers to the possibility that inflation will erode the purchasing power of the bond’s future cash flows. Inflation can reduce the real value of the bond’s future cash flows, reducing the bond’s overall return.

There is also the risk of liquidity risk. This refers to the possibility that there may not be enough buyers or sellers for the bond, making it difficult to sell or buy the bond at a fair price.

Finally, there is reinvestment risk, which refers to the possibility that when a bond matures or is sold, the investor may not be able to find a similar investment that provides the same return. If interest rates have fallen, the investor may have to reinvest their money in a lower yielding bond, which can lead to a lower overall return.

Inflation and interest rates

Inflation and interest rates are often closely related, as changes in inflation can impact interest rates, and vice versa.

In general, inflation refers to the rate at which the general level of prices for goods and services is increasing over time. When inflation is high, the purchasing power of money decreases, since the same amount of money can buy fewer goods and services. Central banks may respond to high inflation by increasing interest rates, in order to slow down economic growth and reduce demand for goods and services. This, in turn, can help to reduce inflation, since higher interest rates can make borrowing more expensive and slow down spending.

On the other hand, when inflation is low, central banks may decrease interest rates in order to stimulate economic growth and encourage borrowing and spending. Lower interest rates can make borrowing cheaper and incentivize businesses to invest in new projects and hire more workers, which can help to stimulate economic activity.

Thus, there is often an inverse relationship between inflation and interest rates: as inflation increases, interest rates tend to increase, and as inflation decreases, interest rates tend to decrease. However, the relationship between inflation and interest rates is not always straightforward, and other factors such as economic growth, monetary policy, and global events can also impact both inflation and interest rates.

The Fisher effect: The Fisher effect defines the relationship between real rates, nominal rates and inflation:

(1 + R) = (1 + r)(1 + h), where

R = nominal rate

r = real rate

h = expected inflation rate

Approximation is R = r + h

The approximation works well with ‘normal’ real rates of interest and expected inflation. If the expected inflation rate is high, then there can be a substantial difference. For example, currently, the inflation rate is high. Therefore the approximation and the actual calculation will vary to a greater extent. Let’s take an example.

If you require a 10% real return and you expect inflation to be 8%, what is the nominal rate?

R = (1.1)(1.08) – 1 = 0.188 = 18.8%

Approximation: R = 10% + 8% = 18%

Because the real return and expected inflation are relatively high, there is a significant difference between the actual Fisher effect and the approximation.

In late 1997 and early 1998 there was a great deal of talk about the effects of deflation among financial experts, due in large part to the combined effects of continuing decreases in energy prices, as well as the upheaval in Asian economies and the subsequent devaluation of several currencies. How might this affect observed yields? According to the Fisher Effect, you should observe lower nominal rates and higher real rates and that is roughly what happened. The opposite situation, however, occurred in and around 2008.

What is happening now?

Term structure of interest rates

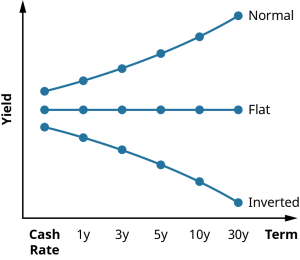

The term structure of interest rates, also known as the yield curve, refers to the relationship between the yield on bonds of different maturities. In other words, it is a graph that shows the interest rates for different periods of time, ranging from short-term to long-term bonds.

In a typical yield curve, short-term bonds tend to have lower yields than long-term bonds, reflecting the fact that investors generally expect to be compensated with higher returns for taking on the risk of holding bonds for longer periods of time. This pattern is known as a normal yield curve.

However, the yield curve can also take on other shapes depending on market conditions. For example, in a flat yield curve, yields are similar for bonds of different maturities. In a steep yield curve, long-term yields are significantly higher than short-term yields.

.The term structure is illustrated by the yield curve, which plots bond yield against term to maturity:

- Normal – upward-sloping; long-term yields are higher than short-term yields

- Inverted – downward-sloping; long-term yields are lower than short-term yields

- Flat – imply interest rates unlikely to change in near future.

Image: Principles of Finance by OpenStax CC BY 4.0 International License.

The shape of the yield curve can be influenced by several factors, including inflation expectations, economic growth expectations, monetary policy decisions, and market demand for different types of bonds. Analysts and investors often study the yield curve as an indicator of future economic and financial conditions, as it can provide insights into market expectations for inflation, growth, and interest rates.

The term structure of interest rates and the risk of default are two key factors that are important in valuing debt securities.

The term structure of interest rates is important because it determines the interest rate that will be paid on a bond or other debt security. The term structure refers to the relationship between the yields on bonds of different maturities, and this relationship can have a significant impact on the value of a bond. Typically, longer-term bonds have higher yields than shorter-term bonds, reflecting the fact that investors demand a higher return for holding bonds for longer periods of time. When valuing a bond, the term structure of interest rates is used to determine the appropriate discount rate to apply to the bond’s cash flows.

The risk of default is also an important consideration when valuing debt securities. The risk of default refers to the possibility that the issuer of a bond will be unable to make its payments on time or in full. If an issuer defaults on its obligations, investors may not receive the full amount of principal and interest that they are owed. This risk is reflected in the credit rating of a bond, which is an assessment of the issuer’s ability to make its payments. When valuing a bond, the risk of default is used to adjust the bond’s cash flows to reflect the possibility of a partial or total loss of principal or interest.

Overall, both the term structure of interest rates and the risk of default are important factors to consider when valuing debt securities. These factors can have a significant impact on the value of a bond, and investors must take them into account when making investment decisions.

Concept 4: Duration of bonds

Duration

.Use the following formula to calculate duration of a bond.

| 3.4 | Duration of a bond | [latex]D=\sum_{{t}={1}}^{{t}}\left(\frac{{{PV}({C}}_{t})}{{P}_{0}}\right){t}=\frac{{PV}\left({C}_{1}\right)\times{1}}{{P}_{0}}+\frac{{PV}\left({C}_\mathbf{2}\right)\times\mathbf{2}}{{P}_\mathbf{0}}+\ldots+\frac{{PV}\left({C}_{n}\right)\times{t}}{{P}_\mathbf{0}}[/latex]

[latex]D=\frac{\sum_{ {t}=\mathbf{1}}^{ {t}}\frac{{C}_ {t}\times {t}}{\left(\mathbf{1}+ {r}\right)^{t}}}{\sum_{ {t}=\mathbf{1}}^{{t}}\frac{{C}_it{t}}{{(\mathbf{1}+{r})}^{t}}}=\frac{\frac{{C}_\mathbf{1}\times\mathbf{1}}{\left(\mathbf{1}+{r}\right)^\mathbf{1}}+\frac{{C}_\mathbf{2}\times\mathbf{2}}{\left(\mathbf{1}+{r}\right)^\mathbf{2}}+\ldots+\frac{{C}_{t}\times{t}}{\left(\mathbf{1}+{r}\right)^{t}}}{\frac{{C}_\mathbf{1}}{{(\mathbf{1}+{r})}^\mathbf{1}}+\frac{{C}_\mathbf{2}}{{(\mathbf{1}+{r})}^\mathbf{2}}+\ldots+\frac{{C}_{t}}{{(\mathbf{1}+{r})}^{t}}}[/latex] |

Duration and immunisation

.Duration and elasticity

When interest rates change, all bond prices respond in the opposite direction, but not to the same extent.

Different bonds have different interest elasticities.

Bond duration has a tight link with interest rate elasticity and the price response to interest rate changes.

The interest elasticity of a bond’s price is proportional to its duration.

| 3.5 | Interest elasticity of a bond’s price | [latex]E\ =-\left(\frac{1}{1+r}\right)D[/latex] |

Duration and bond price changes

Given that duration can be related to interest elasticity, it follows that it is possible to use duration to work out the approximate percentage price change that will occur for a given change in interest rates.

For ‘small’, discrete changes in interest rates and bond prices, we have the following approximation:

| 3.6 | Percentage change in price of bond | [latex]\frac{∆P_0}{P_0}≈-\left(\frac{1}{1+r}\right)D∆r[/latex] |

Concept 5: Factors that affect bond coupon rate

There are many risk factors that can affect coupon rate of a bond:

- Interest rate risk

- Marketability of Bonds: Marketability refers to the ability of an investor to sell securities quickly at a low transaction cost. If companies issue low marketable bonds, they will have to increase their bond coupon rate to compensate the low marketability.

- Default Risk: The possibility of a failure on the borrower’s part to meet, repay the debt or meet interest payments. If companies issue bonds with high default risk, they will have to increase their bond coupons to compensate the investor for this additional risk.

- Call Provisions: A call provision gives the company issuing the bond the option to purchase the bond at a pre-determined price (call price), and the investor MUST sell it at that price. If bonds have call provisions, the company has to compensate the investor with a higher coupon.

References:

- Peirson, G., Brown, R., Easton, S. A., Howard, P., & Pinder, S. (2015). Business finance (Twelfth edition). McGraw-Hill Education.

- Ross, S. A., Trayler, R., Hambusch, G., Koh, C., Glover, K., Westerfield, R., & Jordan, B. (2021). Fundamentals of corporate finance (Eighth edition.). McGraw-Hill Education (Australia) Pty Limited.

- Parrino, R., Au Yong, H. H., Dempsey, M. J., Ekanayake, S., Kidwell, D. S., Kofoed, J., Morkel-Kingsbury, N., & Murray, J. (2014). Fundamentals of corporate finance (Second edition.). John Wiley and Sons Australia, Ltd.