Roy Larke

Learning Objectives

Analyse a brand’s competition by comparing it with similar brands based on the key choice criteria that customers use.

Competitive Analysis

An alternative method of analysing competition is Competitive Analysis. Analysing competition is important for a number of reasons:

- It helps to understand the competitive environment in which a brand or company operates

- It allows for a comparison in performance between competitors

- It offers opportunities to identify gaps in the market that could be addressed

- It allows a brand or company to understand their weaknesses or gaps in comparison to competitors

- It helps a brand or company to develop a unique value proposition

- It is useful as a tracking tool to understand how a market is changing over time.

Getting Started with Competitive Analysis

A competitive analysis can be achieved in multiple ways. For B2C businesses, it is vitally important to consider how customers view different brands, so a good place to start is to compare brands (or companies) based on the key choice criteria used by customers in that particular market.

These criteria can vary hugely between different types of customers or in different locations, so defining the market may also be important. Some brands might be used in different ways by different people. For example, the same model of bicycle might be used by some customers for their daily commute, but others might only use the bicycle at weekends.

Step 1: Brainstorm the key choice criteria for your brand based on the value proposition

As a first step, it is important to decide why customers choose your brand. This will usually mirror the brand’s value proposition. Competitors’ value propositions should differ in some ways, but as competitors, they will be offering similar products that customers consider as alternatives to your own. Therefore, the choice factors that customers use will usually be similar.

Some of the things to consider when creating a detailed value proposition. You should draw on your earlier SWOT analysis for part of this:

| Factors to consider | Questions to answer | Example |

| Our Uniqueness | What’s unique about our company and our brand compared to any other? What makes us special? How unique is this factor within the market? | Whittaker’s unique capability may be its long history as the premium chocolate brand in the New Zealand market specifically. |

| Market Minimal requirements | What are the minimal requirements in terms of skills and capabilities that any company or brand requires to compete in this market? (All brands should have these capabilities, e.g. ) | All chocolate companies will need access to cacao and other ingredients. |

| Our Strengths | What does the company (or brand) do particularly well? What’s really important for your brand/company (which may not be unique)? | Whittaker’s chocolate is made from ethically sourced cocoa through the Rainforest Alliance. [1] |

| Weaknesses |

What are your weak areas (especially in comparison with competitors)? |

The company is small/has a small market share

The brand is new/not well-known |

Step 2: Competing Brands or Companies

Based on your understanding of the greater market, you should next identify key competing companies and/or brands. Remember that this will include any brand that a customer may choose as an alternative to the one you’re analysing. In most cases, these will be clearly related (e.g customers choosing between a bar of Whittaker’s chocolate or a bar of Nestle Kitkat), but you may also need to consider a broader range of options (e.g. customers choosing a chocolate brand or a brand of potato crisps as both as snacks).

To begin with, you should brainstorm a list of possible competing brands, ensuring that this is as broad as possible. This may well mean visiting local stores or other points of sale to see what is available. Online search is also useful here, and for many product categories, there are market reports and other secondary data sources that companies can use to understand the different competing brands within a particular sector of a particular market (although these are mostly commercial tools that are not always available for students). Some examples of these include:

Although these are mostly global companies, most brands need to understand the local market in which they operate. Therefore, it is important to use data sources that include specific data on the New Zealand market.

Once you have a list of competing brands, you should consolidate this down to up to 10 brands maximum based on your value proposition, market share data, and observational data in the market itself (for example, from store visits).

Make a list of these brands.

Step 3: Customer Choice Criteria

After completing a value proposition analysis, brand managers should be aware of the types of choice criteria that they expect customers to use. For example, they may consider ‘Price’ to be a key choice criterion. Some of the most common would be:

- Price

- Trust (of the brand)

- Options (i.e. variety of different types)

- Availability by channel (how easily customers can find the product)

- Availability in the local area

However, simply assuming that a brand knows clearly the choice criteria used by customers may be shortsighted. By observation and through feedback from retailers and so on, a brand might have a good grasp of the choice criteria used for its own products, but it’s likely that:

- The brand may overlook some criteria (e.g. customers who buy chocolate spread to use in cake decoration rather than on toast)

- Criteria used to choose competing brands might be either subtly or completely different (e.g. some customers might avoid buying a brand because of its country of origin)

- Criteria change over time (e.g. as customers become more aware of environmental or ethical issues, they may change the way they choose brands)

Therefore, it is usually important that companies undertake customer research to fully understand how their own and competing brands are viewed and which criteria actual customers use when deciding on the brand they will use. This might include questionnaires or focus groups, for example, where customers are asked which brands they use and why. In the same research, companies will seek to learn the choice criteria that customers may use when choosing brands.

One way to elicit clear, unbiased customer choice criteria is through focus groups using a technique such as a Repertory Grid [see: Reading: Repertory Grid as a simple Qualitative Data Collection Technique].

Some common choice criteria are:

- Specific customer value or benefits:

The brand meets a specific customer need and the way it meets that need becomes a clear, tangible choice factor. For example, sausages that are good for BBQ, or shampoo that is good for dry hair, etc. Often foods are defined by their health benefits, for example. - Physical elements:

What is the product made from? How is this better than competitors? - Price:

People usually look for lower prices, but sometimes, low prices suggest or are an actual indicator of lower quality. - Promotional elements and brand awareness

Different brands may have different levels of market awareness that may relate to the volume and success of the promotions they use. Having well-known promotions (or slogans or specific advertisements, etc.) can be a factor in encouraging choice. - Availability:

It should be easy to find the product where the customer wants to find it. This depends on the product type and the customer’s needs. Some people want to shop at local stores, supermarkets, discount stores, online, and so on. - Trust:

How much people know, like and trust a brand. - Defined aspects of quality:

Quality is often an important choice criterion, but it is also one that needs careful definition. What constitutes higher/lower quality for the specific product category being analysed? For example, quality could be defined by the ingredients, the shelf-life, the use of natural rather than chemical additives, the impact on the environment, the packaging (design, strength, reliability, function, etc.), the ease of use or other product functionality, the taste, the feel, the look of a product and many more factors. It is vitally important to define the factors that determine quality—quality alone is both intangible and non-specific, so it is not a useful measure without further definition. - Quality of service:

Most products are augmented by services, and services alone have a quality factor. Again, the tangible substance of what constitutes quality for a particular product or service category needs to be defined.

Step 4: Competitor Comparison

Once the list of likely competitors within a specific market and a list of possible choice criteria are produced, each competitor can be evaluated against each choice criterion. This may also be done through marketing research, asking customers to rank each competing brand/company against each of the choice factors. By scoring each competing element against each factor, it is possible to produce a straightforward chart to show how brands/companies compare. When creating charts:

- Always include the main brand/company under analysis

- To ensure that charts are easy to understand and read, compare only three or four other brands/companies per chart

- Depending on the software you use, suitable chart types are line charts, spider charts, or possibly scatterplots

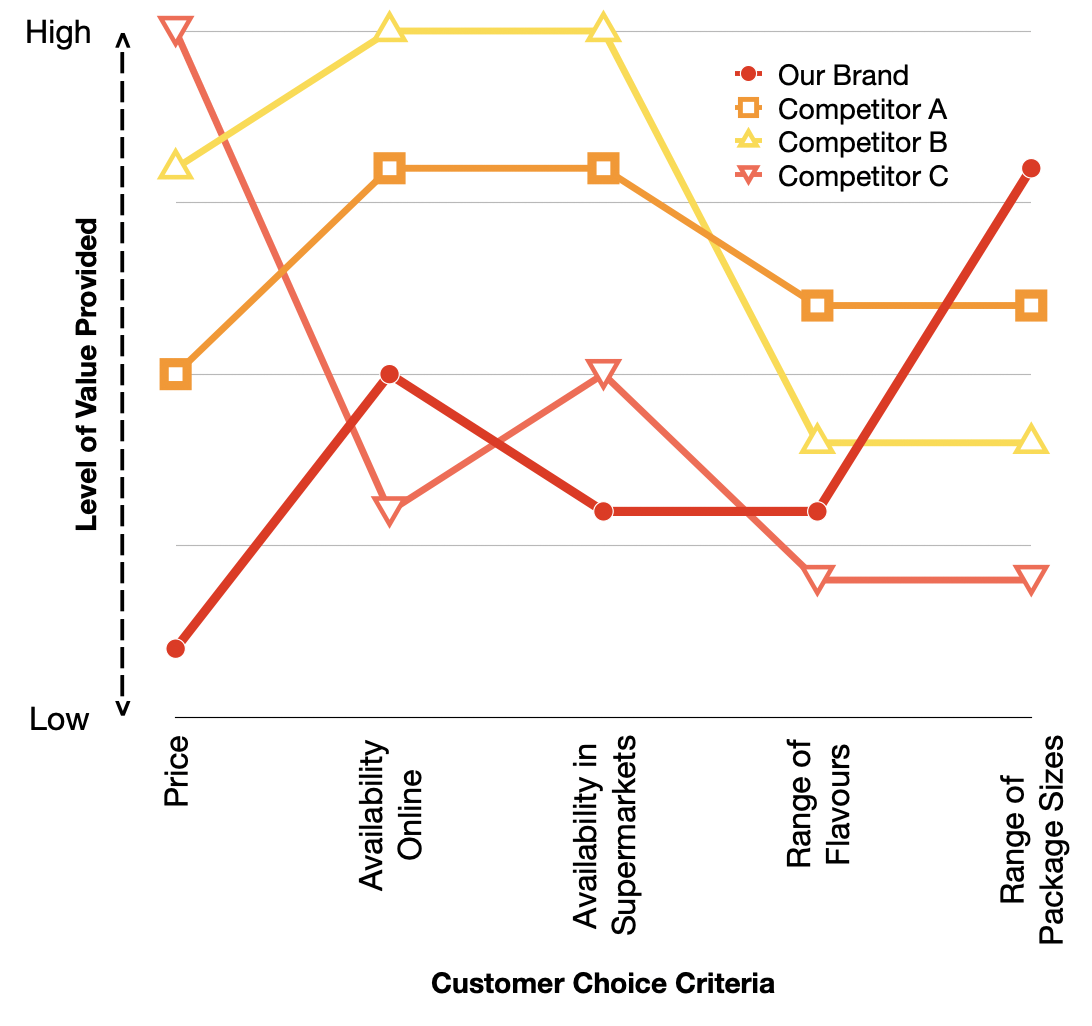

Example 1: Competitive Analysis Chart

The example chart, based on a hypothetical soft drinks brand targeting the Hamilton market in New Zealand, shows five key choice criteria (horizontal axis) and evaluates each one relative to the others from high to low. Even such a simple chart provides some clear ideas as to how the brand compares. For example:

- Our brand has the lowest price and the widest range of package sizes. We may need to consider whether we need to provide as many package sizes as we currently do. Reducing the range of sizes may help reduce costs. More research is required to understand how much customers value the wide range of sizes.

- All but one of our competitors are more widely available online. We may need to consider selling more online.

- All of our competitors are more widely available in supermarkets in Hamilton, so we probably need to make our product more widely available.

- We are not the lowest-ranked in terms of range of flavours, but none of the brands analysed scores highly on this measure. Again, more research would determine how important the range of flavours is to our customers, but as the gap at the top right of the chart shows, there may be an opportunity to offer a wider range of flavours to improve our competitive position.

The same data can be shown in other ways. The following is exactly the same data in a spider or radar chart. Here, comparing the different areas covered in the chart by each brand, it is easy to see that our brand is weaker in most. However, as we’re the cheapest, it’s important to understand just how important price is to our customers.

Detailed Competitive Analysis

Hubspot provides a more detailed look at competitive analysis:

Further Reading on Competitive Analysis

There are many forms of competitive analysis and we present only two fairly simple methods here. It is important to systematically analyse and compare competing brands or companies within specified markets and against key customer choice criteria. This allows us to identify both problems and opportunities. It is also important to remember that the competitive landscape will change frequently, so such analysis needs to be updated on a regular basis.

There are many readings on competitive analysis. The following are a small sample:

- Newton, K. (2024) The Ultimate Guide to Competitive Analysis. 5 April. URL: https://www.brandwatch.com/blog/competitive-analysis/. Accessed 10 June 2024.

- NZTE (2024) How to analyse your competition. URL: https://my.nzte.govt.nz/article/how-to-analyse-your-market-competition. Accessed 10 June 2024.

- Team Asana (2024) How to create a competitive analysis (with examples). 23 February. URL: https://asana.com/resources/competitive-analysis-example. Accessed 10 June 2024.

- White, C. (2024) What is Competitive Analysis—and how to do it. Hubspot. 24 April. URL: https://blog.hubspot.com/marketing/competitive-analysis-kit. Accessed 10 June 2024.

- Xero (2024) How to do competitor analysis. URL: https://www.xero.com/nz/guides/how-to-do-competitor-analysis/. Accessed 10 June 2024.

- Sourcing more ethical cocoa with the Rainforest Alliance ↵

- Available through Waikato University Library for enrolled students. ↵

- Available through Waikato University Library for enrolled students. ↵

- Supports MRKTG308 Strategic Brand Management paper at Waikato Management School. ↵