Chapter 5: Cost Analysis

5.0 Introduction

This chapter examines the cost analysis process, which involves converting historical project data into cost information. The analysed cost data from previous projects can be utilised to formulate cost plans for upcoming projects. This chapter presents a detailed guide to performing a cost analysis in accordance with Australian and New Zealand standards.

5.1 Overview of cost analysis

The cost analysis process helps estimate future project costs by examining past construction project costs and using them to plan and compare costs of new projects.

Cost analysis: Definitions

'… a full appraisal of costs involved in previously constructed buildings … aimed … at providing reliable information which will assist in accurately estimating (the) cost of future buildings. It provides a product-based cost model, providing data on which initial elemental estimates and elemental cost plans can be based.'

— RICS (2012a, p. 12)

'Cost analysis can be defined as the systematic breakdown of costs, according to the sources from which they arise.'

— Seeley (1976)

'A systematic breakdown of tender cost data into the standard elements of a building.'

— Smith et al. (2016)

Costs of past projects should be analysed, arranged and stored in a systematic manner to retrieve when needed for cost planning future projects. Cost information obtained should be reliable, up-to-date and sufficiently detailed as useful for cost planning future projects. A comprehensive cost analysis exercise provides cost information such as unit costs, per area costs or more specific information such as cost per a particular element.

Following a standard document is the best practice to perform a systematic cost analysis.

There are standard documents that can be used for cost analysis exercises in different regions. They provide the basis for measurements (definitions and measurement rules for building areas, elements, etc.) and templates to present cost analysis.

- In Australia, Australian Cost Management Manual (ACMM) Volume 1 (AIQS, 2022)is followed for cost analysis as well as cost planning.

- In New Zealand, the Elemental Analysis of Costs of Building Projects (NZIQS, 2017) is followed.

- In the UK, Elemental Standard Form of Cost Analysis: Principles, Instructions, Elements and Definitions, 4th (NRM) edition (RICS, 2012b) is a dedicated guide to performing a comprehensive cost analysis.

5.3 Types of rates developed from cost analysis

A cost analysis process develops different unit rates. Some common rates developed by cost analysis are:

- functional unit rate

- functional area and other area rates

- elemental rate.

The use of different unit rates under cost planning methods is discussed in Chapter 3 and more details about cost information are discussed in Chapter 4.

5.3.1. Functional unit rate

The rationale behind the functional unit rate is that the total costs of typical buildings, such as car parks, schools and hotels, are proportionally linked to the number of functional units (see Section 3.2.1) of the building. This rate is the most suitable for developing initial project budgets due to lack of available information in early design stages. To ensure accurate unit rates, it is necessary to analyse as many similar projects as possible to derive an average rate.

Total cost of the project ÷ Total number of functional units = Functional unit rate

Example: Functional unit analysis

The total accepted tender cost of a hospital building for 140 beds was $120,000,000. The project was located in Melbourne and the accepted tender cost is from 2008. Let's calculate the functional unit rate.

Functional unit rate for a hospital in Melbourne in 2008 = 120,000,000 ÷ 140 = $85,714.28/m2

5.3.2 Functional area and other area rates

When developing these rates, floor areas are considered as unit quantities.

A building can be divided into different functional areas (see Section 3.2.3 for more details). A functional area rate is established by assigning elemental costs and the cost of preliminaries proportionately to specific functional areas.

ACMM and NZIQS Elemental Cost Analysis standards define several building areas as follows:

- Gross Floor Area (GFA)

- Fully Enclosed Covered Area (FECA)

- Unenclosed Covered Area (UCA)

- Building Area (BA)

- Usable Floor Area (UFA)

- Treated Area (this is mainly used for areas served by engineering services)

- Net Lettable Area (NLA)/Net Saleable Area

- Net Rentable/Tenantable Area.

Chapter 8 provides definitions of key areas with measured examples.

Total cost of the project ÷ Gross Floor Area = Rate per m2 of GFA

GFA calculations: Australia versus New Zealand

It is necessary to follow the same basis for both cost analysis and cost planning – i.e. the same measurement rules should be applied for quantities taken as per the standard followed.

For example, GFA calculation methods are different in Australian and New Zealand standards:

- GFA calculation in Australia excludes external walls

- GFA calculation in New Zealand includes external walls.

For measured examples, see Chapter 8.

Example: GFA calculations

The total accepted tender cost of a hospital building for 140 beds was $120,000,000. The project was located in Melbourne, and the accepted tender cost is from 2008.

The Fully Enclosed Covered Area (FECA) of the building is 39,116m2, and the Unenclosed Covered Area (UCA) is 5,334m2. The total cost for FECA is 114,000,000.00, and UCA is 6,000,000.00.

Total GFA is FECA plus UCA = 39,116m2 + 5,334m2 = 44,450m2

Rate per m2 of GFA = $120,000,000 ÷ 44,450m2 = $2,699.66m2

Rate per m2 of FECA = $114,000,000 ÷ 39,116m2 = $2,914.41m2

Rate per m2 of UCA = $6,000,000 ÷ 5,334m2 = $1,124.86m2

These calculations are summarised in the table below.

| Area type | Full area (m²) | Area as % of GFA | Cost per m² ($) | Cost ($) |

|---|---|---|---|---|

| FECA | 39,116.00 | 88 | 2,914.41 | 114,000,000 |

| UCA | 5,334.00 | 12 | 1,124.86 | 6,000,000 |

| GFA | 44,450.00 | 100 | 2,699.66 | 120,000,000 |

5.3.3 Elemental analysis

In the elemental analysis process, costs are allocated to each element, and an elemental rate is developed by dividing the cost of the element by the quantity of the element. Methods of measurement and units of measurement applied to each element quantity are given in each standard. Inclusions and exclusions in each element should be clearly identified as per the measurement rules. Section 3.2.4 provides more details of element quantities and Chapter 8 provides a few measured examples for key elements as per Australian and New Zealand standards.

Total cost of element ÷ Quantity of element = Element unit rate

Elemental rates are also developed by using GFA as the element quantity.

Total cost of element ÷ GFA = Elemental rate

GFA can also be used when element quantities are not measured.

Example: Elemental cost analysis

The total accepted tender cost of a hospital building for 140 beds was $120,000,000 (including margin). The project was located in Melbourne, and the accepted tender cost is from 2008 (2008.8.31). The GFA of the building, according to the Australian Cost Management Manual (AIQS, 2022), is 44,450m2, and according to the NZIQS Elemental Analysis of Costs of Building Projects standard (NZIQS, 2017), is 44611m2. The reference for the project is HB-20080-Q11.

The project has 892 number of D1 and 456 number of D2. D1 size is 0.8m × 2.1m (area per D1 door 1.68m2). D2 size is 0.9m × 2.1m (area per D1 door 1.89m2). The total cost for all the doors is $2,300,000. The following is an example cost analysis for doors according to the Australian Cost Management Manual and the NZIQS Elemental Analysis of Costs of Building Projects standard.

Total area of D1 doors = 0.8m × 2.1m × 892 = 1498.56m2

Total area of D2 doors = 0.8m × 2.1m × 456 = 861.84m2

Total area for doors = 1498.56 m2 + 861.84 m2 = 2360.4m2

Australian Cost Management Manual

| Project | GFA in m2 | Reference |

|---|---|---|

| Hospital building in Melbourne, 2008 | 44,450 | HB-20080-Q11 |

| Code | Element | Elemental | Gross Floor Area Rate ($/m2)

(Total element cost/GFA) |

Elemental Cost ($) | % BC

(Element cost/total cost) |

||

|---|---|---|---|---|---|---|---|

| Quantity | Unit | Rate

($/unit) |

|||||

| ND | Internal doors | 2360.4 | m2 | 974.41 | 51.74 | 2,300,000.00 | 1.91 |

Elemental Analysis of Costs of Building Projects

| Project | Hospital building in Melbourne, 2008 (GFA 44,611m2) | GFA | 44,611m2 | ||

|---|---|---|---|---|---|

| Element Title: | Internal Doors | Element No: | E11 | ||

| Tender Date: | 2008.8.31 | Margin Included in Element Cost: | Yes | ||

| Element | Quantity | Unit | Element Unit Rate ($/unit) | Elemental cost ($/m2) | Total Cost of Element ($) |

| a | b = d/a | c = d/GFA | d | ||

| Internal door | 2360.4 | m2 | 974.41 | 51.56 | 2,300,000.00 |

5.4 Cost analysis process

This section explains the cost analysis process.

5.4.1 Basis for cost analysis

The first step of cost analysis is to select the base documents from past projects.

According to ACMM, the total project costs used to develop cost breakdowns are taken from the 'accepted tender prices (including accepted tender price adjustments for provisional sums)' of past projects.

According to Elemental Standard Form of Cost Analysis 4th NRM edition, 'the costs analysed shall be the agreed price for the works described. Normally, costs analysed can be the agreed price at ‘commit to construct’, e.g. accepted tender contract sum, agreed target, etc.' (RCIS, 2012b).

The reason for using 'accepted tender prices', 'accepted tender contract sum' or similar is that a project’s construction cost is closely based on the tender price. However, the rules for analysis can be applied at any stage during the project, but this basis should be clearly stated to have a uniform basis of analysed costs.

5.4.2 Information used for cost analysis

It's recommended to obtain the following details from previous projects for the cost analysis process and to present with cost analysis documentation:

- Project details – Project name, tender date, locations, job reference

- Contract details – Contract amount, tender range, type of contract, tender date, reference document and brief description

- Key measurements – GFA, net lettable area, number of stories, wall/ floor ratio, gross floor area, FECA, UCA, usable floor area, net rentable floor area, building area, and area efficiency

- Cost and other factors – Total cost of the project, whether margin included in cost or not, cost weighting %, m2 rate and, Cost Index Reference Series Used

- Element and sub-element details – Elemental group type, description, quantity, unit, unit rate, elemental cost and total cost of the element.

5.4.3 Establishing unit rates

The cost analysis process does not simply calculate costs from one project. Establishing unit rates requires analysing costs from multiple projects. For this process, elemental cost analysis should be conducted for multiple similar projects, and rates from similar functional units should be cumulated to create average rates.

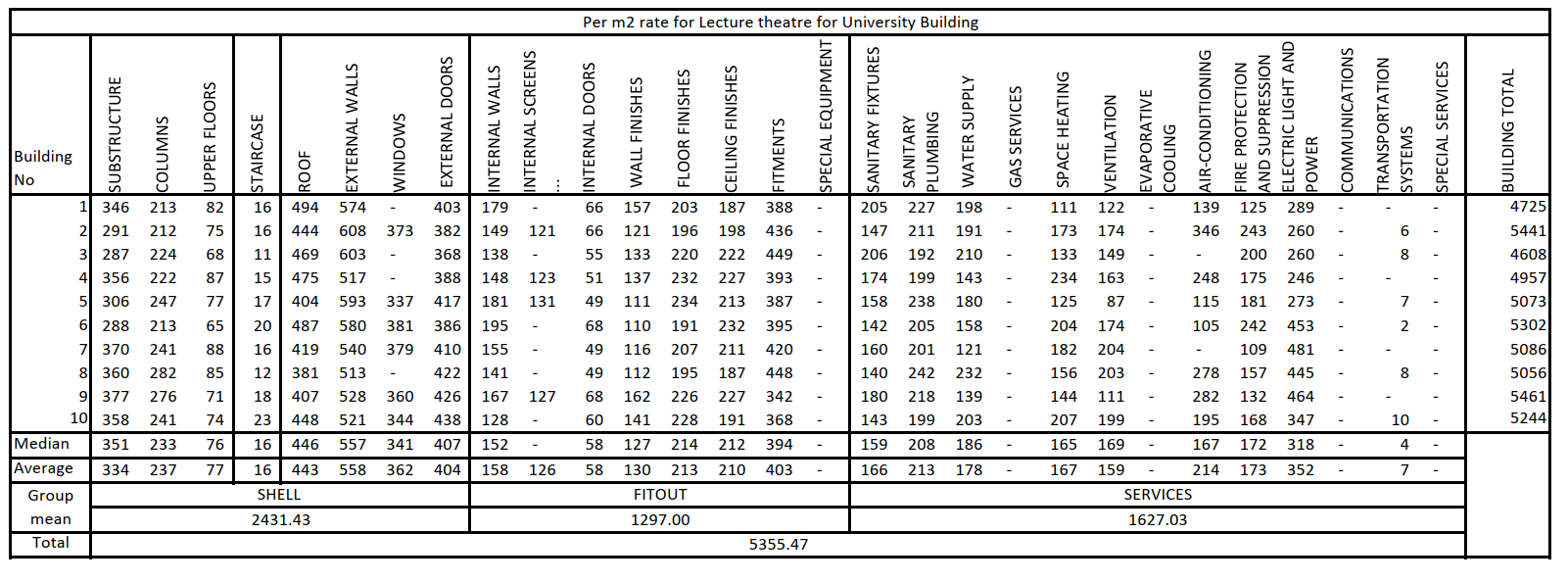

Figure 5.1 showcases a sample matrix derived from cost analyses conducted on 10 university lecture room buildings. It includes columns for elemental rates and total building costs incorporated with elemental cost analysis rates of the 10 university lecture room buildings. Using these rates, mean and average elemental rates are computed. These elemental rates offer greater accuracy than using rates from just one building. Amalgamation of these rates enables the development of per m2 rates for various components such as groups, shell, fit-out, services and the overall building cost.

Industry insights

Some companies conduct cost analysis activities when required during the cost planning stages (i.e. to acquire benchmark rates).

Most professionals mainly focus on developing per m2 rate of GFA since the elemental cost analysis process is time-consuming.

Exercise

The total accepted tender cost of a car parking building for 350 car parking was $10,500,000 (including margin). The project was located in Sydney, and the accepted tender cost is from 2012 (2012.9.31).

The GFA of the building, according to the Australian Cost Management Manual, is 8,750m2, and according to the NZIQS Elemental Analysis of Costs of Building Projects standard is 8,823m2. The reference for the project is CP-FEE01.

The project has 32 number of D1 and 88 number of D2. D1 size is 1.6m × 2.1m. D2 size is 0.9m × 2.1m. The total cost for all the doors is $425,000.

- Calculate the functional unit rate

- Calculate the per m2 unit rate according to the Australian Cost Management Manual (AIQS, 2022) and NZIQS Elemental Analysis of Costs of Building Projects standard (NZIQS, 2017)

- Conduct an elemental cost analysis for doors according to the Australian Cost Management Manual and NZIQS Elemental Analysis of Costs of Building Projects standard

Reflection task

Based on your understanding from previous chapters, now you can try this question.

Read the following information from Project A (old project) and Project B (new project) to find the cost of the roof element for Project B.

Project A details

- GFA= 1000m2

- Cost per m2 of GFA for the Roof Element = $158.25/m2 (Unpublished data − in-house rate)

- Measured quantity of the element from the completed project = 375m2

Project B details

- Measured quantity of the element from the proposed project = 275m2

Answer

Information from Cost Analysis

Cost of the roof retrieved from the Project A = 1000m2 × $158.25/m2 = $158,250.00

Element unit rate = $158,250 ÷ 375m2 = $422.00/m2 (Information used in future cost planning in Project B)

Note: You can also use a construction price book to derive this elemental unit ($422.00/m2).

Information for Cost Planning

Element unit rate (retrieved from previous Project A) = $422.00/m2

Cost of the element of the proposed Project B = 275m2 × $422.00 = $116,050.00